The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at BJ’s Restaurants, Inc. (NASDAQ:BJRI) from the perspective of those successful funds.

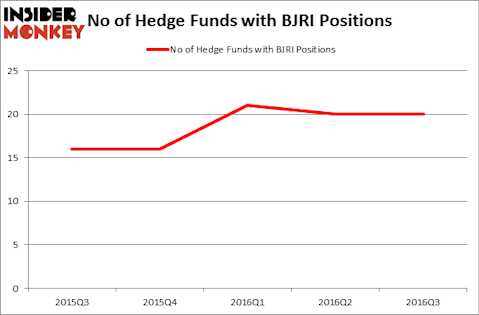

Hedge fund interest in BJ’s Restaurants, Inc. (NASDAQ:BJRI) shares was flat during the third quarter. This is usually a negative indicator. 20 hedge funds that we track owned the stock on September 30, same as on June 30. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Rouse Properties Inc (NYSE:RSE), The Ensign Group, Inc. (NASDAQ:ENSG), and Caleres Inc (NYSE:CAL) to gather more data points.

Follow Bjs Restaurants Inc (NASDAQ:BJRI)

Follow Bjs Restaurants Inc (NASDAQ:BJRI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Joshua Resnic/Shutterstock.com

What does the smart money think about BJ’s Restaurants, Inc. (NASDAQ:BJRI)?

At the end of the third quarter, a total of 20 of the hedge funds tracked by Insider Monkey held long positions in this stock, unchanged from one quarter earlier. Hedge fund ownership of thew stock remains up by 25% over the past year. Below, you can check out the change in hedge fund sentiment towards BJRI over the last 5 quarters. So, let’s review which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Luxor Capital Group, led by Christian Leone, holds the most valuable position in BJ’s Restaurants, Inc. (NASDAQ:BJRI). Luxor Capital Group has an $85.8 million position in the stock, comprising 2.4% of its 13F portfolio. The second most bullish fund manager is Parag Vora of HG Vora Capital Management, with a $30.2 million position; 3.9% of its 13F portfolio is allocated to the stock. Other peers that hold long positions contain Jim Simons’ Renaissance Technologies, Ken Griffin’s Citadel Investment Group, and Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.