After a lengthy stretch of outperformance, small-cap stocks suffered from July 2015 through June 2016, as heightened global economic fears led investors to flee to the safe havens of large-cap stocks and other instruments. Those stocks outperformed small-caps by about 10 percentage points during that time, with small-cap healthcare stocks being particularly hard hit. However, the tide has since turned in a big way, as evidenced by small-caps toppling their large-cap peers by 6 percentage points in the third quarter, and by another 4.0 percentage points in the first seven weeks of the fourth quarter. In this article, we’ll analyze how this shift affected hedge funds’ third-quarter sentiment towards Alphabet Inc (NASDAQ:GOOG) and see how the stock is affected by the recent hedge fund activity.

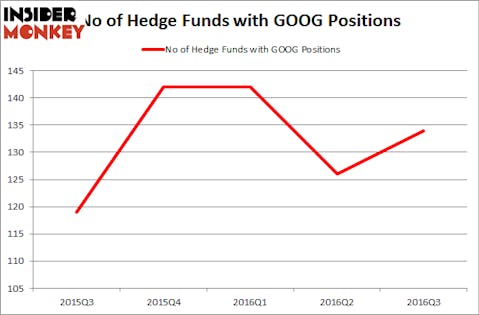

Alphabet Inc (NASDAQ:GOOG)’s class C stock was in 134 hedge funds’ portfolios at the end of the third quarter of 2016. GOOG has seen an increase in enthusiasm from smart money lately. There were 126 hedge funds in our database with GOOG positions at the end of the previous quarter. At the end of this article we will also compare GOOG to other stocks including Microsoft Corporation (NASDAQ:MSFT), Exxon Mobil Corporation (NYSE:XOM), and Berkshire Hathaway Inc. (NYSE:BRK-B) to get a better sense of its popularity.

Follow Alphabet Inc. (NASDAQ:GOOG)

Follow Alphabet Inc. (NASDAQ:GOOG)

Receive real-time insider trading and news alerts

At the moment there are tons of metrics market participants have at their disposal to appraise publicly traded companies. A pair of the less known metrics are hedge fund and insider trading signals. Our experts have shown that, historically, those who follow the top picks of the top hedge fund managers can beat the S&P 500 by a significant margin (see the details here).

Now, we’re going to view the key action regarding Alphabet Inc (NASDAQ:GOOG).

What does the smart money think about Alphabet Inc (NASDAQ:GOOG)?

At the end of the third quarter, a total of 134 funds from the Insider Monkey database were bullish on Alphabet’s class C stock, a change of 6% from one quarter earlier. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Eagle Capital Management, led by Boykin Curry, holds the most valuable position in Alphabet Inc (NASDAQ:GOOG). Eagle Capital Management has a $1.37 billion position in the stock, comprising 5.9% of its 13F portfolio. Coming in second is Southeastern Asset Management, led by Mason Hawkins, which amassed a $836.4 million stake; the fund has 8% of its 13F portfolio invested in the stock. Other hedge funds and institutional investors that hold long positions consist of Andreas Halvorsen’s Viking Global, Stephen Mandel’s Lone Pine Capital and John Armitage’s Egerton Capital Limited.