Out of thousands of stocks that are trading on the US stock market, it may be hard for a retail investor to select those that can help to outperform the market. In this article, let’s focus our attention on four stocks: Callaway Golf Co (NYSE:ELY), Nexstar Broadcasting Group, Inc. (NASDAQ:NXST), Loral Space & Communications Ltd. (NASDAQ:LORL), and Macquarie Infrastructure Corp (NYSE:MIC) and see how they affected the returns of Yost Capital Management, led by Carson Yost. In addition, we are going to take a closer look at the general hedge fund sentiment towards these stocks.

Before we get to the companies, in question, let’s take a closer look at the fund. Yost Capital Management had an equity portfolio of $183.84 million at the end of June, with 39% invested in consumer discretionary stocks. Other sectors in which the fund was invested included transportation, finance, technology, real estate, and healthcare. Out of a total of 12 positions, 10 holdings were in companies with market caps above $1.0 billion. Based on the size of these positions at the end of June, the fund’s equity portfolio had a weighted average return of 15.88% in the third quarter.

solarseven/Shutterstock.com

In Callaway Golf Co (NYSE:ELY), Yost Capital held 2.26 million shares worth $23.05 million at the end of June. The position had a positive impact on the fund’s returns, as the stock advanced by 13.8% during the third quarter. At the end of the second quarter. a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, up by 4% from one quarter earlier. Peter S. Park’s Park West Asset Management had the largest position in Callaway Golf Co (NYSE:ELY), worth close to $27.2 million. The second largest stake was held by Scopus Asset Management, led by Alexander Mitchell, which amassed a $27.1 million position. Kerr Neilson’s Platinum Asset Management and Israel Englander’s Millennium Management also held shares of the company.

Follow Callaway Golf Co (NYSE:CALY)

Follow Callaway Golf Co (NYSE:CALY)

Receive real-time insider trading and news alerts

Then there’s Nexstar Broadcasting Group, Inc. (NASDAQ:NXST), which represented a new position in the fund’s equity portfolio, as the fund amassed 468,337 shares valued at $22.28 million at the end of June. The bet paid off handsomely in the following quarter, as the stock surged by 21.8%. Heading into the third quarter, 41 funds from our database owned shares of Nexstar Broadcasting Group, down by 13% on the quarter. More specifically, MSDC Management was the largest shareholder of Nexstar Broadcasting Group, Inc. (NASDAQ:NXST), with a stake worth $122.8 million reported as of the end of June. Trailing MSDC Management was Brenner West Capital Partners, which amassed a stake valued at $53.1 million. Roystone Capital Partners, Tiger Legatus Capital, and Luxor Capital Group also held valuable positions in the company.

Follow Nexstar Media Group Inc. (NASDAQ:NXST)

Follow Nexstar Media Group Inc. (NASDAQ:NXST)

Receive real-time insider trading and news alerts

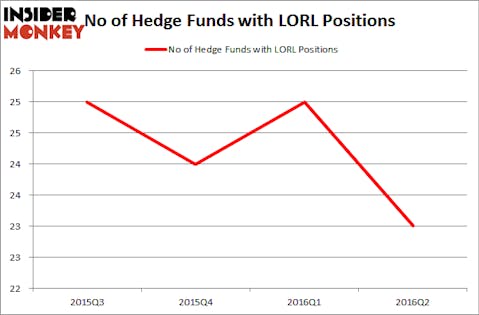

Loral Space & Communications Ltd. (NASDAQ:LORL) also helped to push higher the returns of Yost Capital last quarter, as the stock went up by 10.9%. Heading into the quarter, Loral Space held 514,340 shares worth $18.14 million, being one of 23 funds followed by our team that were bullish on the stock, down by 8% from the end of March. The largest stake in Loral Space & Communications Ltd. (NASDAQ:LORL) was held by MHR Fund Management, which reported holding $300.8 million worth of stock at the end of June. It was followed by Solus Alternative Asset Management with a $75.3 million position. Other investors bullish on the company included Highland Capital Management, Omega Advisors, and Archer Capital Management.

Follow Loral Space & Communications Inc. (NASDAQ:LORL)

Follow Loral Space & Communications Inc. (NASDAQ:LORL)

Receive real-time insider trading and news alerts

Last, but not least, in Macquarie Infrastructure Corp (NYSE:MIC), Yost trimmed its stake by 14% to 234,362 shares worth $17.36 million during the second quarter. During the third quarter, the stock gained 14.2%. Heading into the third quarter, a total of 47 of the hedge funds tracked by Insider Monkey were long this stock, down by four funds from a quarter earlier. More specifically, MSDC Management was the largest shareholder of Macquarie Infrastructure Corp (NYSE:MIC), with a stake worth $215.7 millions reported as of the end of June. Trailing MSDC Management was Brenner West Capital Partners, which amassed a stake valued at $160.9 millions. Newbrook Capital Advisors, Selz Capital, and Tiger Legatus Capital also held valuable positions in the company.

Follow Macquarie Infrastructure Corp (NYSE:MIC)

Follow Macquarie Infrastructure Corp (NYSE:MIC)

Receive real-time insider trading and news alerts

Disclosure: none