Investing in small cap stocks has historically been a way to outperform the market, as small cap companies typically grow faster on average than the blue chips. That outperformance comes with a price, however, as there are occasional periods of higher volatility and underperformance. The time period between the end of June 2015 and the end of June 2016 was one of those periods, as the Russell 2000 ETF (IWM) has underperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points. Given that the funds we track tend to have a disproportionate amount of their portfolios in smaller cap stocks, they have been underperforming the large-cap indices. However, things have dramatically changed over the last 5 months. Small-cap stocks reversed their misfortune and beat the large cap indices by almost 11 percentage points since the end of June. In this article, we use our extensive database of hedge fund holdings to find out what the smart money thinks of Darden Restaurants, Inc. (NYSE:DRI).

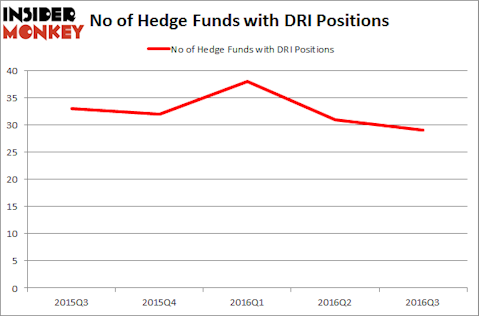

Is Darden Restaurants, Inc. (NYSE:DRI) ready to rally soon? Money managers are in a pessimistic mood. The number of bullish hedge fund bets were cut by 2 recently. DRI was in 29 hedge funds’ portfolios at the end of the third quarter of 2016. There were 31 hedge funds in our database with DRI holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Garmin Ltd. (NASDAQ:GRMN), Crescent Point Energy Corp (NYSE:CPG), and ANSYS, Inc. (NASDAQ:ANSS) to gather more data points.

Follow Darden Restaurants Inc (NYSE:DRI)

Follow Darden Restaurants Inc (NYSE:DRI)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year, involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs.

Copyright: stockbroker / 123RF Stock Photo

With all of this in mind, let’s view the new action encompassing Darden Restaurants, Inc. (NYSE:DRI).

How are hedge funds trading Darden Restaurants, Inc. (NYSE:DRI)?

At Q3’s end, a total of 29 of the hedge funds tracked by Insider Monkey held long positions in this stock, down 6% from the second quarter of 2016. With hedgies’ capital changing hands, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes meaningfully (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Cliff Asness’s AQR Capital Management has the largest position in Darden Restaurants, Inc. (NYSE:DRI), worth close to $143.3 million and comprising 0.2% of its total 13F portfolio. On AQR Capital Management’s heels is David Costen Haley of HBK Investments, with a $48 million position; 0.5% of its 13F portfolio is allocated to the stock. Other members of the smart money with similar optimism consist of D. E. Shaw’s D E Shaw, Joel Greenblatt’s Gotham Asset Management and Jim Simons’s Renaissance Technologies.