The worries about the election and the ongoing uncertainty about the path of interest-rate increases have been keeping investors on the sidelines. Of course, most hedge funds and other asset managers have been underperforming main stock market indices since the middle of 2015. Interestingly though, smaller-cap stocks registered their best performance relative to the large-capitalization stocks since the end of the June quarter, suggesting that this may be the best time to take a cue from their stock picks. In fact, the Russell 2000 Index gained more than 15% since the beginning of the third quarter, while the Standard and Poor’s 500 benchmark returned less than 6%. This article will lay out and discuss the hedge fund and institutional investor sentiment towards Aeglea Bio Therapeutics Inc (NASDAQ:AGLE).

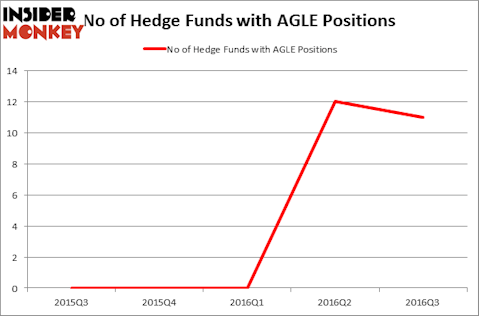

Is Aeglea Bio Therapeutics Inc (NASDAQ:AGLE) a buy here? Investors who are in the know seem to be taking a bearish view. During the third quarter, the number of investors from our database long the stock inched down by one to 11. At the end of this article we will also compare AGLE to other stocks including Datawatch Corporation (NASDAQ:DWCH), Synacor Inc (NASDAQ:SYNC), and Aegerion Pharmaceuticals, Inc. (NASDAQ:AEGR) to get a better sense of its popularity.

Follow Spyre Therapeutics Inc. (NASDAQ:SYRE)

Follow Spyre Therapeutics Inc. (NASDAQ:SYRE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

everything possible/Shutterstock.com

Keeping this in mind, we’re going to take a look at the fresh action surrounding Aeglea Bio Therapeutics Inc (NASDAQ:AGLE).

What have hedge funds been doing with Aeglea Bio Therapeutics Inc (NASDAQ:AGLE)?

As stated earlier, at the end of June, 11 funds tracked by Insider Monkey were bullish on this stock, down by 8% from the previous quarter. Below, you can check out the change in hedge fund sentiment towards AGLE over the last five quarters. With the smart money’s capital changing hands, there exists a select group of noteworthy hedge fund managers who were increasing their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Samuel Isaly’s OrbiMed Advisors has the biggest position in Aeglea Bio Therapeutics Inc (NASDAQ:AGLE), worth close to $8.7 million, corresponding to 0.1% of its total 13F portfolio. Sitting at the No. 2 spot is Rock Springs Capital Management, led by Kris Jenner, Gordon Bussard, Graham McPhail, which holds a $3.4 million position; 0.2% of its 13F portfolio is allocated to the stock. Some other hedge funds and institutional investors with similar optimism encompass Julian Baker and Felix Baker’s Baker Bros. Advisors, Nathan Fischel’s DAFNA Capital Management, and Peter Kolchinsky’s RA Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.