The internet is a very competitive market. For less than $150 anyone can buy a small shared hosting package and start a website. With such low barriers it is easy to think that Google Inc (NASDAQ:GOOG) faces a great amount of competition. The reality is that the amount of financial capital and human capital required to make an operation which can compete with Google is enormous. It is easy to get lost in all of the talk of Google’s eminent demise. In reality Google is a secure player in multiple online sectors with huge barriers to entry.

According to one study, the major uses of the internet are e-mail, gathering information, online banking, sharing content, geographical navigation services, and online shopping. Google covers almost all of these services. Gmail, Google+, and Blogger help people communicate and share content. Google News is one of the most popular news sites in the world. Google Maps provides directions, and the recent fiasco with Apple’s map app shows just how difficult developing a good map app can be. Google Shopping helps people to shop online. Although it does not offer the same level of service as Amazon, it is still one of the top affiliate networks.

Google has built this empire while maintaining great financials. They have a total debt to equity ratio of .09 with $14.8 billion in cash and equivalents at the end of 2012. Their ROA of 11.8% and ROI of 14.9% are healthy. With a profit margin of 21.4% it is easy for the company to maintain steady free cash flow to invest in their operations and fund acquisitions.

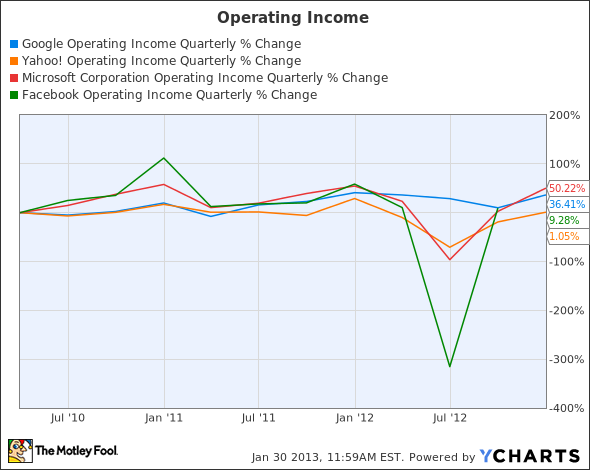

GOOG Operating Income Quarterly data by YCharts

How Does the Competition Compare?

The above chart shows how Yahoo! Inc. (NASDAQ:YHOO)‘s operating income has not grown at the same rate as Google’s or Microsoft Corporation (NASDAQ:MSFT)’s. Yahoo!’s CEO, Marissa Mayer, has not been with the company for a long time but she still has her work cut out for her. Yahoo! does not have the strong search business to fall back on like Google. Yahoo! Mail and Yahoo! News are both popular products, but they do not offer the same competitive advantage as a profitable search business. For the first three quarters of 2012 display page views decreased 5%, while search page views decreased 13% relative to the same period in 2011. Nevertheless, Yahoo!’s ROA of 19.4% and ROI of 25.3% are encouraging. Even with a clean balance sheet with no debt, the lack of operating income growth over the past couple years is concerning. For years Yahoo! and Google have fought back and forth, and yet Google has been able to grow a larger product suite and provide more operating income growth.