There are several ways to beat the market, and investing in small cap stocks has historically been one of them. We like to improve the odds of beating the market further by examining what famous hedge fund operators such as Carl Icahn and George Soros think. Those hedge fund operators make billions of dollars each year by hiring the best and the brightest to do research on stocks, including small cap stocks that big brokerage houses simply don’t cover. Because of Carl Icahn and other successful funds’ exemplary historical records, we pay attention to their small cap picks. In this article, we use hedge fund filing data to analyze San Juan Basin Royalty Trust (NYSE:SJT).

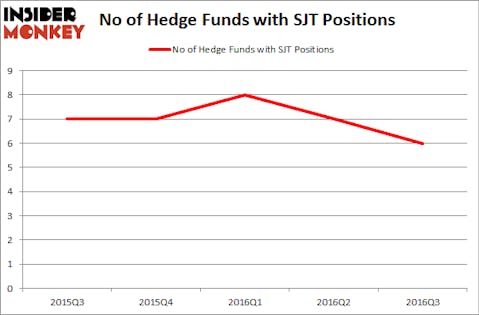

San Juan Basin Royalty Trust (NYSE:SJT) has seen a decrease in support from the world’s most successful money managers lately. SJT was in 6 hedge funds’ portfolios at the end of the third quarter of 2016. There were 7 hedge funds in our database with SJT positions at the end of the second quarter. At the end of this article we will also compare SJT to other stocks including Oil-Dri Corporation of America (NYSE:ODC), Mitek Systems, Inc. (NASDAQ:MITK), and AxoGen, Inc. (NASDAQ:AXGN) to get a better sense of its popularity.

Follow San Juan Basin Rty Tr (NYSE:SJT)

Follow San Juan Basin Rty Tr (NYSE:SJT)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Pradit.Ph / Shutterstock.com

How are hedge funds trading San Juan Basin Royalty Trust (NYSE:SJT)?

At Q3’s end, a total of 6 of the hedge funds tracked by Insider Monkey were long this stock, a 14% decrease from one quarter earlier, dropping hedge fund ownership to a yearly low. Below, you can check out the change in hedge fund sentiment towards SJT over the last 5 quarters. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were boosting their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Chuck Royce’s Royce & Associates has the biggest position in San Juan Basin Royalty Trust (NYSE:SJT), worth close to $7.7 million. The second largest stake is held by MFP Investors, led by Michael Price, which holds a $0.6 million position. Other peers with similar optimism consist of Russell Hawkins’ Hawkins Capital, John Overdeck and David Siegel’s Two Sigma Advisors, and Ken Griffin’s Citadel Investment Group. We should note that MFP Investors is among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.