Company summary

Rock-Tenn Company (NYSE:RKT) provides containerboards, packaging, and pre-printed linerboards for corrugated boxes, and industrial and consumer product manufacturers. They also convert corrugated sheets into corrugated products; and provide structural and graphic design and engineering services, and packaging machines.

Bottom line: the application of their products is seemingly endless and is in steady and growing domestic and global demand. If you as a consumer buy a product it’s typically boxed or wrapped, it could be Rock-Tenn Company (NYSE:RKT).

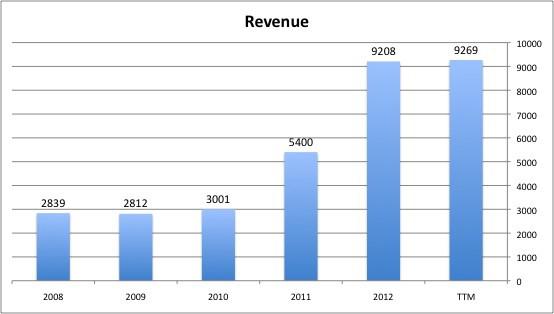

Revenue Growth Supported by CAPex

The correlation between Revenue Growth and Capital Expenditures with Share Price should be clearly evident upon examination. We see the benefit to investing back into the business here. Rock-Tenn’s management has been vocal about continuing this trend.

Cash is king

As referenced earlier, Rock-Tenn Company (NYSE:RKT) has produced strong and steady cash flows and has consistently maintained a Free Cash Flow/Net Income Ratio greater than 1, a sign of quality earnings in my book. Remember how this ratio works. If a company is playing accounting games (ie. Enron) than we will see Net Income but won’t see the accompanying Cash Flow. If the two are similar (ratio around 1) then we are confident they are ‘converting Net Income into real Cash Flow’.

Rock-Tenn plans to reinvest $450 million towards capital maintenance, equipment and infrastructure modernization/upgrades, and high-return, cost-reducing projects that improve operational efficiency. Operating Cash Flows have been growing with revenues and have averaged 9% of Revenues over the past decade. As seen below, reinvestment back into the firm has consumed a greater portion of these cash flows in the past year and a half and this has translated to both revenue and share price growth. All this indicates long-term thinking by management, investing in the future of the company.

International Paper Company (NYSE:IP) is seen following suit in the same fashion. They are investing a huge amount of money in expanding their business and upgrading machinery. In the last 3 years alone they have spent more than $7 billion on the business, a fairly large sum for a $21 billion company. The race between International Paper Company (NYSE:IP) and Rock-Tenn Company (NYSE:RKT) will be competitive and ultimately lead to consolidation in this industry. Look for smaller players like Clearwater Paper Corp (NYSE:CLW) to become potential acquisition targets. At a current market cap of just over $1 billion we would be more likely to see International Paper Company (NYSE:IP) make a play for Clearwater Paper Corp (NYSE:CLW), as they have roughly a billion in cash right now. Rock-Tenn has only $60 million in cash but is no stranger to raising $1 billion+ to purchase a company, as they did in 2011.

In May of 2011, Rock-Tenn finalized their acquisition of a company called Smurfit-Stone Container Corporation, a company twice the size of Rock-Tenn, by raising more than $1.1B in debt. In doing so, they tripled their revenue. 2011 was a transitional year for Rock-Tenn and with the complex process of such an acquisition and the integration of these two companies, the company encountered higher operational and employee restructuring/new-hire costs. However, these costs have decreased and will continue to do so as they achieve full integration. The debt raised is costing Rock-Tenn an extra $44 million a year in interest charges. This increases the leverage of the company and makes execution vital. I believe the $100 million increase in earnings year over year more than covers this cost.

Rock-Tenn Company (NYSE:RKT) has beaten earnings estimates the past 3 quarters and 6 out of the last 8. Their most recent earnings surprise was +9.8%. Since their first dividend payment of 0.03/share in May of 1994, they have consistently increased their dividend payments. In May of 2013, they again increased their dividend payment by 33% from $0.90/share to $1.20/share. Competitor Clearwater Paper Corp (NYSE:CLW) missed on earnings last week, a sign that Rock-Tenn’s success is not just industry based. They are strong executors.

I believe that Rock-Tenn has positioned itself for further gains and profitability. Rock-Tenn has demonstrated their ability to grow their business while increasing investor value, and I believe that they are committed and able to continue growing even further.

The article Rock-Tenn Will Surprise You With Gains This Year originally appeared on Fool.com and is written by Hunter Orr.

Hunter Orr has no position in any stocks mentioned. The Motley Fool owns shares of Rock-Tenn Company. Hunter is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.