Should you be interested in investing in Qualys Inc (NASDAQ:QLYS), ServiceNow Inc (NYSE:NOW), Skyworks Solutions Inc (NASDAQ:SWKS), and Cavium Inc (NASDAQ:CAVM)? One fund that is certainly bullish on these tech stocks is Vivek Mehta and Aaron Husock‘s ShearLink Capital.

ShearLink Capital had an equity portfolio that was worth $229.75 million at the end of June. With 13 ‘relevant’ positions in the companies that were worth $1 billion or more at the end of the second quarter, the fund had posted a weighted average return of 15.49%. It is worth mentioning that our measurements of the weighted average return may differ from the actual returns because we don’t factor in short positions, and some other instruments. Nevertheless, these measurements also give us a good idea of the fund’s investment skills.

Having this in mind, let’s take a closer look at the aforementioned fund’s top tech picks, and see what kind of returns they brought in the third quarter.

everything possible/Shutterstock.com

We’ll start with a company that provides cloud-based security solutions, Qualys Inc (NASDAQ:QLYS), in which the fund lowered its stake by 10% to 988,243 shares during the second quarter. Lowering of the stake maybe was no the best move for the fund, seeing that the stock advanced by 28.1% in the third quarter. At the end of June, 13 funds tracked by Insider Monkey were bullish on this stock, a change of 30% from the previous quarter. More specifically, Alyeska Investment Group was the largest shareholder of Qualys Inc (NASDAQ:QLYS), with a stake worth $51.1 million reported as of the end of June. Trailing Alyeska Investment Group was Nokota Management, which amassed a stake valued at $44.3 million. Elliott Management, and Renaissance Technologies also held valuable positions in the company.

Follow Qualys Inc. (NASDAQ:QLYS)

Follow Qualys Inc. (NASDAQ:QLYS)

Receive real-time insider trading and news alerts

Next in line is another company that offers cloud-based solutions, ServiceNow Inc (NYSE:NOW), in which the fund decided to boost its stake by 56% to 379,227 shares worth $25.18 million during the second quarter. In the next three months, the stock advanced by 19.2%. ServiceNow Inc (NYSE:NOW) was included in the equity portfolio of 31 funds from our database at the end of June, while there were 28 hedge funds in our database with NOW holdings at the end of the previous quarter. The largest stake in ServiceNow Inc (NYSE:NOW) was held by Citadel Investment Group, which reported holding $201.9 million worth of stock at the end of June. It was followed by Criterion Capital with a $135.5 million position. Other investors bullish on the company included Columbus Circle Investors, Alyeska Investment Group, and SRS Investment Management.

Follow Servicenow Inc. (NYSE:NOW)

Follow Servicenow Inc. (NYSE:NOW)

Receive real-time insider trading and news alerts

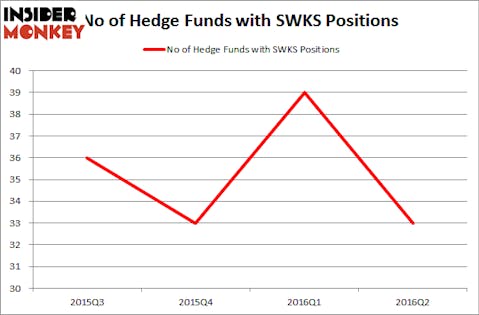

We are continuing with the ShearLink Capital’s top tech pick, but this time instead of a company that offers cloud-based solutions, we have a company that produces analog semiconductors, Skyworks Solutions Inc (NASDAQ:SWKS). The fund significantly raised its stake in the company, by 168% to 369,991 shares, creating a position that was valued at at $23.41 million at the end of June. Expectations weren’t disappointed as the stock returned 20.8% in the next three months. At the end of the second quarter, a total of 33 of the hedge funds tracked by Insider Monkey held shares of Skyworks Solutions, down by 15% over the quarter. The largest stake in Skyworks Solutions Inc (NASDAQ:SWKS) was held by Citadel Investment Group, which reported a $235. position. On the secons spot was Platinum Asset Management with a $65.6 million position. Other investors bullish on the company included Hoplite Capital Management, and Roystone Capital Partners.

Follow Skyworks Solutions Inc. (NASDAQ:SWKS)

Follow Skyworks Solutions Inc. (NASDAQ:SWKS)

Receive real-time insider trading and news alerts

The last stock among ShearLink Capital’s top tech picks we are going to discuss is another company that produces semiconductor processors, Cavium Inc (NASDAQ:CAVM). During the June quarter, the fund acquired 589,816 shares worth 22.77 million. This was a great addition to the fund’s portfolio since the stock surged by 50.8% in the following three months. At the end of the second quarter, a total of 20 of the hedge funds tracked by Insider Monkey were bullish on this stock, up by 25% from one quarter earlier. Among these funds, Citadel Investment Group, managed by Ken Griffin, held the largest position in Cavium Inc (NASDAQ:CAVM), which was worth $79.7 million. The second largest stake was held by Raging Capital Management, led by William C. Martin, holding a $32.2 million position. Other peers that are bullish encompass Phill Gross and Robert Atchinson’s Adage Capital Management, and Clint Carlson’s Carlson Capital.

Follow Cavium Inc. (NASDAQ:CAVM)

Follow Cavium Inc. (NASDAQ:CAVM)

Receive real-time insider trading and news alerts

Disclosure: None