Dividend stocks outperform non-dividend-paying stocks over the long run. It happens in good markets and bad, and the benefit of dividends can be quite striking: Dividend payments have made up about 40% of the market’s average annual return from 1936 to the present day. But few of us can invest in every single dividend-paying stock on the market, and even if we could, we might find better gains by being selective. That’s why we’ll be pitting two of the Dow Jones Industrial Average (Dow Jones Indices:.DJI)‘s dividend payers against each other today to find out which Dow Jones Industrial Average (Dow Jones Indices:.DJI) stock is the true dividend champion. Let’s take a closer look at our two contenders now.

Tale of the tape

Pfizer Inc. (NYSE:PFE) is a recent addition to the Dow Jones Industrial Average (Dow Jones Indices:.DJI), having only been part of the index for nine years. Hailing from New York City, Pfizer Inc. (NYSE:PFE) earned its spot by becoming the largest pharmaceutical company in the United States thanks to a multiyear surge in revenue. That isn’t to say Pfizer Inc. (NYSE:PFE) was small before; it has always been on the vanguard of the modern pharmaceutical industry, which it helped to create with drug mass-production techniques and energetic sales operations.

UnitedHealth Group Inc. (NYSE:UNH) is the Dow Jones Industrial Average (Dow Jones Indices:.DJI)’s most recent addition, and it will celebrate its first anniversary on the index in about two and a half months. Headquartered in the suburbs of Minneapolis, Minn., UnitedHealth Group Inc. (NYSE:UNH) is also the market leader in its field. It’s the largest health insurer in the U.S., serving about 70 million Americans through a network of more than 700,000 physicians and other health care professionals.

| Statistic | Pfizer | UnitedHealth |

|---|---|---|

| Market cap | $197 billion | $65.5 billion |

| P/E ratio | 13.4 | 12.6 |

| TTM profit margin | 27% | 4.7% |

| TTM free-cash-flow margin* | 26.5% | 3.1% |

| Five-year total return | 80.3% | 96.8% |

Source: Morningstar and YCharts.

* Free cash flow margin is free cash flow divided by revenue for the trailing 12 months.

This might be a closer battle than you’d think, given big pharma’s tendency toward high margins and high yields. UnitedHealth Group Inc. (NYSE:UNH) might not have that edge over Pfizer, but its lower valuations present it as a company with a potentially longer dividend growth runway. Will pills win out over premiums? Let’s find out.

Round one: endurance

According to Dividata, Pfizer Inc. (NYSE:PFE) began paying dividends in 1982 and has been paying ever since. UnitedHealth Group Inc. (NYSE:UNH) comes in at an immediate disadvantage, as it was only founded five years before Pfizer Inc. (NYSE:PFE) started paying out — and it does indeed come up short, as Dividata shows that UnitedHealth Group Inc. (NYSE:UNH) only began paying dividends in 1990, and it only switched from annual payouts to quarterly distributions in 2010.

Winner: Pfizer, 1-0

Round two: stability

Paying dividends is well and good, but how long have our two companies been increasing their dividends? The same dividend payout year after year can quickly fall behind a rising market, and there’s no better sign of a company’s financial stability than a rising payout in a weak market (so long as it’s sustainable, of course). Pfizer Inc. (NYSE:PFE) slashed its dividend during the financial crisis, so it has only been raising payouts since 2010. UnitedHealth Group Inc. (NYSE:UNH) also began increasing its dividend in 2010 after a stretch of flat annual payouts, but the company has never cut its dividend. Because of this, it will earn the victory here.

Winner: UnitedHealth, 1-1

Round three: power

It’s not that hard to commit to paying back shareholders, but are these payments enticing or merely token? Let’s take a look at how both companies have maintained their dividend yields over time as their businesses and share prices grow:

PFE Dividend Yield data by YCharts.

Winner: Pfizer, 2-1

Round four: strength

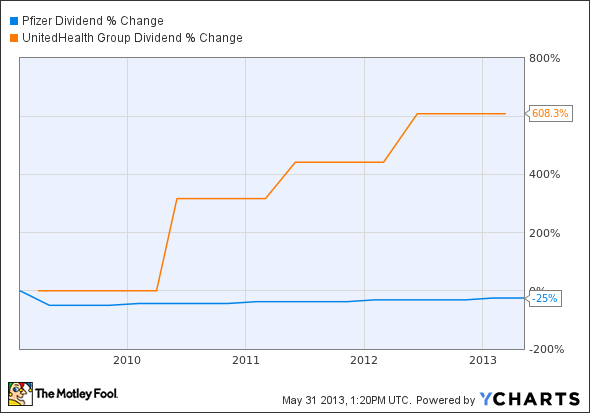

A stock’s yield can stay high without much effort if its share price doesn’t budge, so let’s take a look at the growth in payouts over the past few years. If you bought in several years ago and the company has grown its payout substantially, your real yield is likely to look much better than what’s shown above.

PFE Dividend data by YCharts.

Winner: UnitedHealth, 2-2

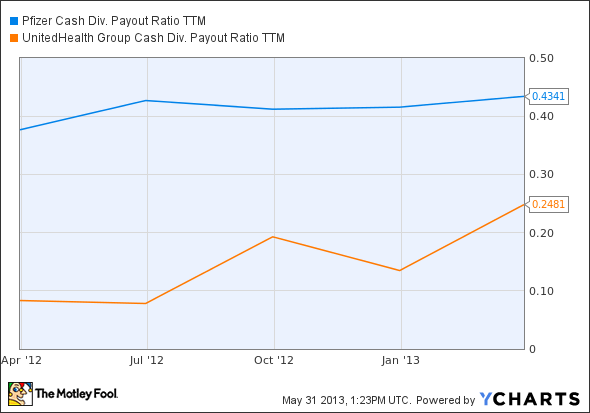

Round five: flexibility

A company needs to manage its cash wisely to ensure that there’s enough available for tough times. Paying out too much of free cash flow in dividends could be a warning sign that the dividend is at risk, particularly if business weakens. This next metric analyzes just how much of their free cash flows our two companies have paid out in dividends over the past four quarters:

PFE Cash Div. Payout Ratio TTM data by YCharts.

Winner: UnitedHealth, 3-2

In a surprise win, the low-margin health insurer comes out ahead of the high-yielding pharmaceutical giant. There’s no doubt that shareholders have enjoyed great gains from both stocks in recent years, but a higher ceiling on potential dividend increases, combined with a fantastic recent history of such increases, puts UnitedHealth Group Inc. (NYSE:UNH) on top today. Would you rather invest in America’s top pharmaceutical maker or its top health insurer? With Obamacare on the way to full implementation and a patent cliff on Pfizer Inc. (NYSE:PFE)’s horizon, this could be a more difficult choice than many investors think.

The article Pfizer vs. UnitedHealth: Which Dow Stock’s Dividend Dominates? originally appeared on Fool.com and is written by Alex Planes.

Fool contributor Alex Planes holds no financial position in any company mentioned here. Add him on Google+ or follow him on Twitter @TMFBiggles for more insight into markets, history, and technology.The Motley Fool recommends UnitedHealth Group (NYSE:UNH).

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.