When a famous activist investor builds his stakes in certain publicly traded companies, shareholders might expect that he would push for corporate actions to unlock hidden value in them. Recently, it was reported that Nelson Peltz, a famous activist investor in the consumer goods industry, has been building stakes in both PepsiCo, Inc. (NYSE:PEP) and Mondelez International Inc (NASDAQ:MDLZ) through his Trian Fund Management. After the news, both companies moved up around 3% in one trading day.

PepsiCo – Big profits from America

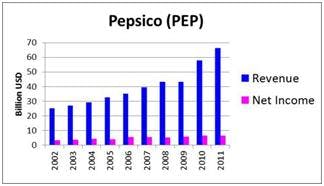

PepsiCo, with 29.9% of the global market share in 2011, is the second biggest global soft drink company, only after Coca-Cola. The company has seen some improvement from the turnaround plan it laid out last year. Both its fourth-quarter revenue and earnings exceeded analysts’ expectations.

Fourth-quarter net revenue was $19.95 billion, while net income came in at $1.66 billion, or $1.06 per share. For the full year 2012, PepsiCo generated nearly $65.5 billion in revenue and $6.18 billion in net profits, or $3.92 per share. Revenue witnessed an organic growth of around 5% in the fourth quarter and the full year.

Interestingly, the PepsiCo, Inc. (NYSE:PEP) Americas Foods segment is the biggest revenue contributor, with $1.7 billion in 2012 operating profit, while the PepsiCo, Inc. (NYSE:PEP) Americas Beverages segment contributed around $735 million in operating profit. In the America Foods segment, the majority of its operating profit, $1.11 billion, or nearly 40% of the total operating profit, was generated from Frito-Lay North America, while the other food sub-segments, including Quaker Foods North America and Latin America Foods contributed only $200 million and $386 million in operating profit, respectively.

Mondelez International Inc (NASDAQ:MDLZ) – The leader in the emerging markets

While PepsiCo, Inc. (NYSE:PEP) generates a great deal of profit from American Foods segment, Mondelez International Inc (NASDAQ:MDLZ) derived the majority of its revenue and income from emerging markets. In 2012, developing markets accounted for 45.4% of the total operating income, while Europe and North America represented around 35.4% and 19.2% of the total operating income, respectively.

What might interest investors, and Nelson Peltz as well, is the fact that Mondelez is the global market leader in Biscuits, Chocolate, Powdered Beverages, and Candy.

What attracts me further is Mondelez International Inc (NASDAQ:MDLZ)’s talented and shareholder oriented chief, Irene Rosenfeld. She is quite famous in the food & beverage industry with nearly 30 years of experience. Even though Warren Buffett didn’t like her move to sell the pizza business to purchase Cadbury, he has endorsed her to be a good businesswoman.

Irene Rosenfeld oversaw Mondelez International Inc’s strong growth in BRIC markets:

“Our first priority is the BRIC markets. Brazil, India, Russia and China represent about a third of our developing market revenues and will receive the lions share of our resources. Over the next five years, these countries are expected to grow mid- to high-teens and account for a significant portion of our growth.”

At around $30 per share, Mondelez International Inc (NASDAQ:MDLZ) is worth nearly $54 billion. I personally think that Mondelez is still undervalued at its current valuation of 12.6 times EV/EBITDA due to its huge potential and consistent growth. PepsiCo, Inc, at around $78 per share, has a much higher market cap of $120 billion. It is valued a bit cheaper at 11.8 times EV/EBITDA.

Danone has already been one of his targets

At the end of 2012, Nelson Peltz also accumulated up to 1% economic interest in one of the largest French food companies, Groupe Danone . Nelson Peltz said that there were three reasons for him to invest in the company.

First, the company owned a great “21stcentury” portfolio under three business segments: Yogurt, Bottled Water, and Baby/Medical Nutrition. Groupe Danone is considered to be a Yogurt leader with 23% of the global market share. Second, Danone also has great exposure to emerging markets, which accounted for 52% of its total sales. Thus, Nelson Peltz thought the company was quite cheap. He thought that Danone should be worth €78 ($60.60) per share by the end of 2014.

Foolish bottom line

I am not sure about Nelson Peltz’s motives for those two big consumer foods giants, but with his successful activist investment record, investors might expect to see his push for corporate actions in the two companies in the near future.

The article Big Investor Gets Active in Big Consumer Foods Giants originally appeared on Fool.com written by Anh HOANG

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.