From an investing standpoint, Apple Inc. (NASDAQ:AAPL) is affected by many different factors over the short run, but as we lengthen the time frame, the stock’s fortunes are undoubtedly tied to earnings growth. Valuation and future product releases are important as well, but investors won’t give the stock much support if its bottom line isn’t up to snuff.

With that being said, there’s quite a bit of improper reporting flying around the blogosphere and we thought it’d be best to set the record straight.

According to most armchair analysts, Apple investors should remain wary about next quarter’s (Q1 FY2013) financials, particularly on the earnings front. Officially, Wall Street’s 42 most prominent Apple Inc. (NASDAQ:AAPL) analysts are predicting the company to finish Q1 with earnings of $13.46 per share, down 3% year over year, from Q1 FY2012’s EPS of $13.87.

Unbeknownst to a surprisingly large fraction of the media, though, Apple’s current 13-week quarter is actually seven days shorter than Apple’s fiscal Q1 in 2012. When we adjust Apple Inc. (NASDAQ:AAPL) earnings estimates taking this fact into consideration, we can paint a decidedly different picture of the tech giant’s bottom line.

How exactly can we do this?

The easiest way to achieve this transformation is to compute Q1 earnings into weekly averages. In Q1 FY2012, Apple earned close to 99 cents per week over a 14-week period. In Q1 FY2013, however, analysts expect the company to earn an average of $1.04 per week over a 13-week time frame.

Thus, we can actually see that Apple Inc. (NASDAQ:AAPL) is expected to see modest EPS growth near 5% this quarter, and when we adjust EPS estimates for a longer time frame, we can see that earnings estimates would eclipse $14.50 if the current fiscal Q1 was 14 weeks long.

These calculations are important to make, because it’s crucial for investors to understand the full scope of Apple’s upcoming earnings release, due for January 23, 2013.

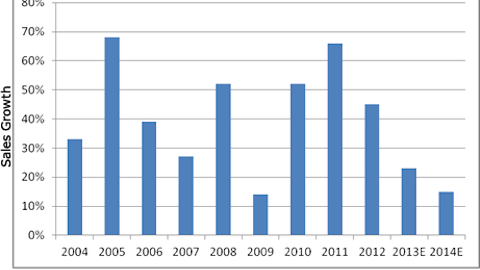

Over the longer term, the sell-side expects the company to generate EPS growth of 19-20% a year over the next half-decade, above what’s expected of Google (15.7%) and Microsoft (9.6%). While this expansion is slowing down – Apple Inc. (NASDAQ:AAPL) averaged EPS growth of 62.2% a year over the past five years – it’s still better than the company’s closest competitors.

With that being said, these estimates obviously don’t take into account the effects that an Apple TV would have on the company’s bottom line, which could generate additional upside of 5-10% (see Apple TV Could Add $4.50 to EPS: Analyst).

Let us know how you’re trading Apple in the comments section below, and if you’re encouraged or discouraged by the company’s growth prospects. For more Apple Inc. (NASDAQ:AAPL) coverage, continue reading below:

Apple, China Mobile Deal Expected Next Year: Analyst

Massive Differential in Apple’s iPhone Market Share Estimates