Hedge funds on average underperform the market in bull markets because they are hedged. In our analysis of hedge funds’ performance, we consider only their long positions in non-microcap stocks. In this way, we can compare their returns to the returns of the S&P 500 ETFs, which are basically 100% long portfolios of large-cap stocks. NWI Management was just one of the 627 funds tracked by Insider Monkey whose long performance was positive in the third quarter, as they collectively averaged 8.3% with their qualifying picks. NWI Management’s picks returned 13.83% from its 21 positions in billion-dollar companies on June 30.

The New York-based investment fund, run by Hari Hariharan, had a public equity portfolio valued at $1.20 billion as of the end of June. In this article we’ll take a look at some of its top picks and see how they performed in Q3, including Apple Inc. (NASDAQ:AAPL), Petroleo Brasileiro Petrobras SA (ADR) (NYSE:PBR), Comcast Corporation (NASDAQ:CMCSA), and T MOBILE US INC (NYSE:TMUS).

NWI Management retained its stake in Apple Inc. (NASDAQ:AAPL) throughout the second quarter and it proved to be a good decision, as the stock returned 18.9% in the third quarter. The fund had about 1 million shares of the tech giant in its portfolio on June 30, valued at $95.92 million. Apple shares have slumped by about 4% in the fourth quarter however, as its latest quarterly results failed to impress.

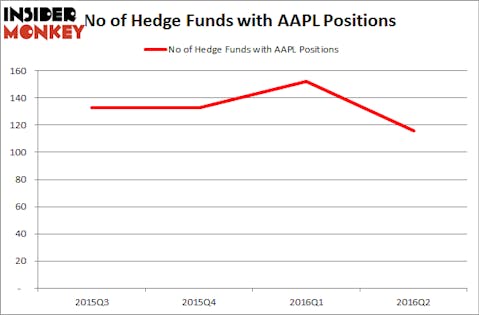

The hedge funds in our system weren’t overly impressed by Apple’s prospects in the second quarter either, as a net total of 36 funds axed their positions in the stock. AAPL was in 116 hedge funds’ portfolios at the end of the second quarter of 2016, down from 152 at the end of the previous quarter. According to Insider Monkey’s hedge fund database, Berkshire Hathaway, managed by Warren Buffett, holds the most valuable position in Apple Inc. (NASDAQ:AAPL). Berkshire Hathaway has a $1.46 billion position in the stock, comprising 1.1% of its 13F portfolio. Sitting at the No. 2 spot is Fisher Asset Management, managed by Ken Fisher, which holds a $1.10 billion position. Remaining peers with similar optimism comprise Phill Gross and Robert Atchinson’s Adage Capital Management, David Einhorn’s Greenlight Capital, and Eric W. Mandelblatt’s Soroban Capital Partners.

Follow Apple Inc. (NASDAQ:AAPL)

Follow Apple Inc. (NASDAQ:AAPL)

Receive real-time insider trading and news alerts

NWI Management ended the second quarter with a total of 5.79 million shares of Petroleo Brasileiro Petrobras SA (ADR) (NYSE:PBR), which had a total value of $41.52 million, the position also being unchanged during the quarter. The stock returned 30.3% during the third quarter, as the political situation in Brazil became a little clearer, among other things. Shares have gained another 10% in the current quarter.

At the end of the second quarter, a total of 23 of the hedge funds tracked by Insider Monkey were long this stock, unchanged quarter-over-quarter. The largest stake in Petroleo Brasileiro Petrobras SA (ADR) (NYSE:PBR) was held by Arrowstreet Capital, which reported holding $137.7 million worth of stock asof the end of June. It was followed by Fisher Asset Management with an $83.9 million position. Other investors bullish on the company included Renaissance Technologies and Horseman Capital Management.

Follow Petroleo Brasileiro Sa Petrobras (NYSE:PBR)

Follow Petroleo Brasileiro Sa Petrobras (NYSE:PBR)

Receive real-time insider trading and news alerts

We’ll check out two more of the fund’s stock picks on the next page.

A total of 600,000 shares of Comcast Corporation (NASDAQ:CMCSA) were amassed by NWI Management as of the end of the June quarter, up by 20% from the end of March. The total value of the position stood at $39.11 million on June 30 and accounted for 3.25% of the value of the fund’s equity portfolio. Comcast’s stock returned 2.2% in the quarter ended September 30.

Comcast Corporation (NASDAQ:CMCSA) investors should be aware of a decrease in hedge fund sentiment of late. CMCSA was in 88 hedge funds’ portfolios at the end of June, down from 90 at the end of the previous quarter. According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, First Eagle Investment Management holds the most valuable position in Comcast Corporation (NASDAQ:CMCSA) on June 30, valued at $1.71 billion. Coming in second is Alex Snow of Lansdowne Partners, with a $1.60 billion position. Some other hedge funds and institutional investors that hold long positions consist of Fisher Asset Management, John Armitage’s Egerton Capital Limited, and Ken Griffin’s Citadel Investment Group.

Follow Comcast Corp (NASDAQ:CMCSA)

Follow Comcast Corp (NASDAQ:CMCSA)

Receive real-time insider trading and news alerts

NWI Management sold off 3% of its big stake in T MOBILE US INC (NYSE:TMUS) in the second quarter, during which time the stock returned over 10%. T Mobile’s stock couldn’t quite repeat that feat, but did return 8% during the third quarter. The fund had a $36.78 million stake in the company, which comprised 850,000 shares. Morgan Stanley recently reiterated an ‘Overweight’ rating on T Mobile and believes that its 2016 was overly conservative.

Heading into the third quarter, a total of 52 of the hedge funds tracked by Insider Monkey were long T Mobile. The largest stake in T MOBILE US INC (NYSE:TMUS) among them was held by Viking Global, which reported holding $604.3 million worth of its stock as of the end of June. It was followed by Soroban Capital Partners with a $389.4 million position. Other investors bullish on the company included Marshall Wace LLP and Jericho Capital Asset Management.

Follow T-Mobile Us Inc. (NASDAQ:TMUS)

Follow T-Mobile Us Inc. (NASDAQ:TMUS)

Receive real-time insider trading and news alerts

Disclosure: None