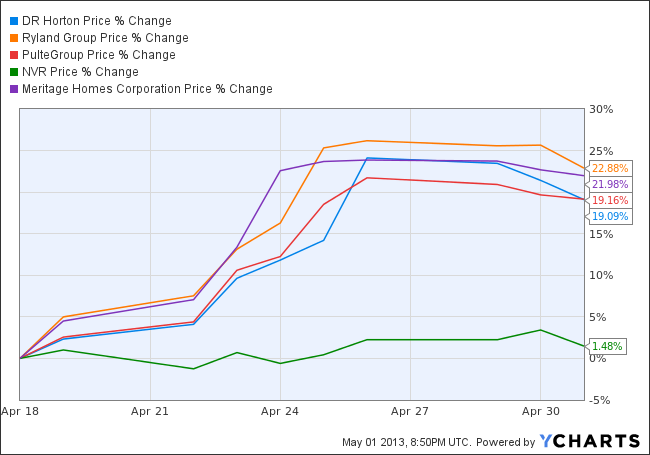

Although strong industry tailwinds have helped to lift all of these stocks, each respective homebuilder has been making their own changes to help position themselves a bit better in the industry.

D.R. Horton, Inc. (NYSE:DHI) is one of the largest national home builders, with a focus on single-family houses. D.R. Horton, Inc. (NYSE:DHI) managed to generate solid cash flow from operations despite the housing downturn of recent years. The company built up a cash to almost $650 million and now has homebuilding leverage of only 33%.

D.R. Horton, Inc. (NYSE:DHI)’s new home orders, backlogs and homes delivered were all up by double-digit percentages year-over-year for 2012. Meanwhile, the company is leveraging fixed costs to help increase production in an effort to meet stronger demand. This includes selective land acquisitions in an effort to ensure that there is enough supply in key markets.

The Ryland Group, Inc. (NYSE:RYL) saw a 47% increase in revenue for 2012, while consensus sees revenue jumping another 56% in 2013. First-quarter EPS results showed that new home orders (in units) increased 54% from a year earlier, with more new contracts and a strong increase in demand leading the way. Its first-quarter earnings beat was on the back of higher average selling prices and better margins. Unfortunately, Ryland is also the most expensive of these stocks from a price-to-book basis.

PulteGroup, Inc. (NYSE:PHM) was making various workforce reductions and cutting overhead costs during the housing downturn. This has helped the company reduce selling, general and administrative expenses substantially, while also helping to bolster the company’s margins. SG&A as a percentage of revenue went from 13.2% in 2011 to 11.3% in 2012.

PulteGroup, Inc. (NYSE:PHM) is one of the dominant builders of active adult communities. The key here is that this is one of the fastest-growing segments of housing, thanks in part to the increasing age of the population. The U.S. Census projects that the number of Americans in the 55-to-75 age group will reach roughly 80 million by the end of 2020.

Analysts believe that PulteGroup, Inc. (NYSE:PHM) will grow its earnings-per-share impressively over the next five years, though much like Ryland it is too expensive from a P/E and P/B basis.

NVR, Inc. (NYSE:NVR) posted first-quarter EPS of $6.84, compared to $3.90 for the same period last year. Unfortunately, this fell far short of consensus forecasts of $8.08. Revenue was up 28% last quarter on a year-over-year basis, but again fell well short of the 41% gain projected by consensus.