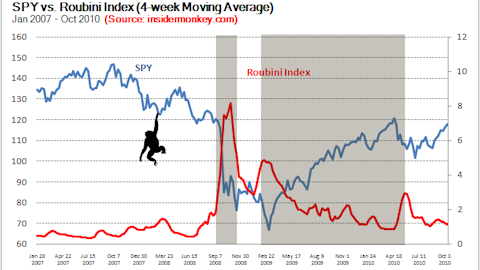

Nouriel Roubini, the New York University professor who predicted the 2008 financial crisis, and Ian Bremmer, president of Eurasia Group, talk about the outlook for the global economy and China – U.S. relations on Bloomberg today.

On China:

Roubini expects a significant slowdown of growth in China in 2012, which will also be seen in the Q1 numbers. “The Chinese will react by reducing the reserve requirement ratio and interest rates to try and jumpstart the economy.” said Roubini.

Roubini think the move on rates is going to happen in the first half of the year when the numbers in Q1 are weak

Ian Bremmer believes that there is a high risk for an unpleasant policy surprise out of China. “The economics are driving the geopolitics and that’s after decades when really security issues drove the geopolitics,” said Bremmer, “the U.S. talking about geopolitics. U.S. talking about economic statecraft right now about, they’ve done this not in a proactive way, they’ve done this because American allies in Asia have been begging for the United States to show commitment, whether it’s Singapore or Vietnam, whether it’s Japan or all the rest.”

Bremmer said: “When it comes to the United States and China let’s be clear. Structurally these countries are moving towards more conflict. These are the world’s two largest economies and that clearly is problematic in terms of economics volatility over the longer term. But as of for this year the American economy is dominating. It’s not foreign policy, and there can be a little bit of noise on Iran, a little bit of noise on China. When it comes to currency, the Chinese have been moving at their pace, very slowly, very incrementally, and American politicians have to show they don’t like it. But to be clear, American multinational corporations are perfectly happy with it, they manufacture in China. They are on the other side of this game. It’s American Labor that has the problem with Chinese currency. And they don’t have a lot of influence with the Republicans right now.”

On Europe

“It depends on where we are looking. In the case of the Eurozone, it’s clearly the periphery is not just in a recession but a deepening recession.” Roubini said, “so the eurozone is in a recession, the UK looks like it’s going towards a recession. The data from the United States has been somehow more mixed, positively lately but in my view the process of deleveraging the public and private sector is going to continue that implies slow domestic growth demand and the exports of the United States are not going to improve.”

(see the full video here)