According to New York Times, News Corp announced that it had attracted more than 100k paying customers to the online versions of some of its British newspapers. News Corp predicted that the number of visitors to their British sites would drop by 90%. However, the recent stats reveal that the actual decline in unique visitors is only 42%.

Insider Monkey, your source for free insider tradingdata, believes the stats announced by News Corp are at best misleading. When you start charging for content that’s available for free somewhere else, you will see a huge decline in the number of pageviews. Yes, we did not say “unique visitors”, we said pageviews. You may have a million “unique” visitors visiting your homepage (which is free) but you may have a big problem if they just visited your homepage and left.

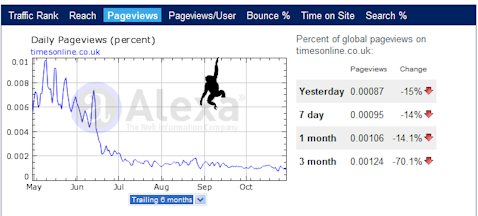

News Corp didn’t reveal the pageview stats in its announcement. So, we went to Alexa.com and found nearly a 90% decline in pageviews for the timesonline.co.uk (the site is part of the News Corp family) website. As you can see from the graph above, in May the average pageview share of timesonline.co.uk was around 0.0075. In June, after the pay wall went into effect, their share went down to 0.002. And now, it’s 0.001. It seems like people still keep visiting the website out of habit and there is a delayed reaction to switch to other free general news websites. That’s why we observe a more than 50% decline over the past 4 months. Overall, they lost nearly 90% of their pageviews.

The New York Times has a lot to learn from News Corp’s experience. Internet advertising will get bigger and print advertising will keep contracting. It’s obvious to us that pay walls are not the answer to their problem. Erecting pay walls will kill the goose that lays a golden egg (albeit, a small one) every day. News Corp is giving a false impression by saying it’s ok to pay for news that can be found free elsewhere online. They’re pointing to a 100k subscriber count as proof of success. But they get less than a dollar from each paying subscriber. Through the new scheme, they lost nearly 9 out of 10 of their visitors. Since each visitor generates more than 10 cents a day, it doesn’t make sense to give up 9 visitors to get less than a dollar a day from one paying subscriber. It’s only chump change they’re losing – yes- but that adds up, and the revenue stream guidelines will eventually change again. Meanwhile, News Corp is moving in the opposite direction.

Insider Monkey, the smartest monkey on Wall Street, has a piece of advice for the New York Times: don’t let News Corp fool you into erecting a pay wall. People are stupid enough to pay for bottled water, but they are not stupid enough to pay for free news.