The Video On Demand (systems by which users select and watch video content on demand) market is becoming more and more attractive. Since 2010, new competitors, from start-ups to gigantic entertainment content companies, have joined the game. This has caused the market to be more competitive, as competitors fight for distributing more content, increasing video quality (high definition) and download speed and reducing their subscription fees.

But this is just the beginning. In order to become future market leaders and attract more subscribers, some competitors are making huge investments, as you will see later. After all, the market leader will not only enjoy several competitive advantages in terms of cost efficiency, but it will also have the biggest exposure to a very promising and huge market: in September 2012, Nielsen mentioned that 162 million Americans watched online video. They spent almost seven hours of the month viewing content, streaming nearly 26 billion videos.

Furthermore, the U.S. is just an example of how far video streaming penetration can go in an economy. As users in Europe and emerging markets in Asia and Latin America shift from TV to video on demand, the international market for video streaming is even more attractive. Any company that succeeds in expanding its video services internationally is set to experience amazing revenue growth rates for the next three years. But, who will win the war for the video streaming market?

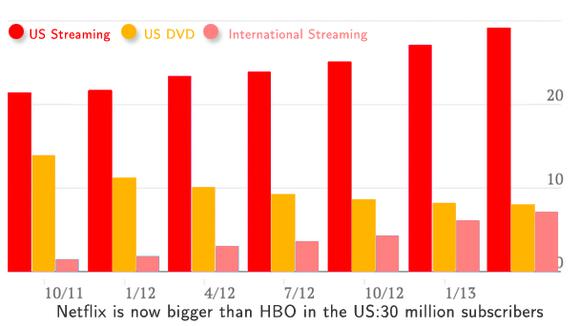

Netflix, Inc. (NASDAQ:NFLX) : Now Bigger than HBO

Netflix, Inc. (NASDAQ:NFLX) is an early mover. It wisely used cash from its DVD rental business to enter into the streaming business in the U.S. some years ago, and this move proved to be very successful Now, Netflix has more than 32 million subscribers in the U.S., Canada, Latin America, Ireland, and the United Kingdom. Even better, there is room for further growth, not only abroad.

In the U.S., Americans still watch more than eight hours of television per day (Nielsen). As Americans continue shifting to video on demand, Netflix, Inc. (NASDAQ:NFLX) is likely to attract many new customers with its huge content database. In the last quarter, Netflix, Inc. (NASDAQ:NFLX) added 2 million new members in the U.S. and roughly 1 million new members abroad.

Although Netflix, Inc. (NASDAQ:NFLX)’s growth has been amazing, the company has several challenges to face from now on. First of all, Netflix is able to capture customers because of its large content database: without content, Netflix would not be able to survive. This puts limits on Netflix’s profitability and adds risks due to the uncertainty of negotiations with content providers in the future. Netflix has a relatively larger content budget relative to the competition.

In many cases, the company might be overpaying for content, while Amazon.com, Inc. (NASDAQ:AMZN) and Hulu are not. Also, Netflix is already so big that it is relying on emerging markets to continue promising outstanding revenue growth to investors. We don’t know for sure if these markets will be profitable in the medium run, because content providers in these markets are also interested in providing their own video streaming service (like Televisa in Mexico) and would only sell their content for elevated fees.