Over the past decade, as shown by the chart below, shares of the world’s largest online travel booking site, Priceline.com Inc (NASDAQ:PCLN), are up more than 3,000%. However, there are reasons why I believe the rally can continue.

Valuation

Despite trading at an all-time high, as shown by the chart below, Priceline.com Inc (NASDAQ:PCLN) is not trading close to historic highs on a forward PE-ratio basis. This means that, based on historical valuation, Priceline.com Inc (NASDAQ:PCLN) is not expensive.

PCLN Forward PE Ratio data by YCharts

Short Interest

Currently, short interest in Priceline.com Inc (NASDAQ:PCLN) stands at 2.72 million shares or 5.5% of the float. The high short interest indicates that, despite trading at all-time highs, many investors are still skeptical about Priceline.com Inc (NASDAQ:PCLN). If the stock continues to move higher, shorts will likely feel pressure to cover, which can lead to a short squeeze.

Cash

Currently, Priceline has more than $5 billion – or $103.51 per share – in cash. While the company has yet to say what it plans to do with the money, on the first quarter 2013 conference call CEO Jeffery Boyd said:

“And with respect to cash use, we do believe that there will be opportunities in the future to deploy our cash in our international cash in particular either through investing in the business and growing the business or in acquisitions and as you mentioned, I can’t get specific with that. But we do believe there are attractive businesses out there, we have been reasonably acquisitive as a company. … And with respect to other uses of cash as we said before, we have been buyers of our common stock and repurchase from time to time.”

Simply put, I would look for the use of cash going forward as a positive upcoming catalyst. Whether it be an acquisition or a return of cash to shareholders via an increased buyback or dividend, I believe any use of cash will be a positive. Priceline has a long track record of successful acquisitions including Kayak.com.

Debt-Financed Buyback

Just days ago, Priceline announced plans to buy back $1 billion of stock. The company is financing the transaction by issuing seven-year convertible notes. I would look for the buyback to put upward pressure on shares.

Improving Economic Outlook

Priceline is poised to benefit from the improving economic outlook as individuals will become more likely to travel. In particular, the rising stock market, which creates a wealth effect, should help the travel sector as a whole.

Risks

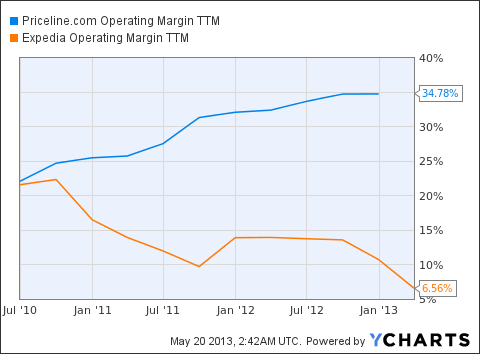

In my opinion, the biggest risk facing Priceline over the long term is competition. Both Expedia Inc (NASDAQ:EXPE)) and Orbitz Worldwide, Inc. (NYSE:OWW) have proven strong competitors. Currently, Priceline has gross profit margins of 34%. Over time, I think it is possible that margins are driven lower for Priceline because of competition. However, as Priceline CEO Boyd noted, Priceline has done a good job of maintaining its foothold on the market.

“… on the competition question, Expedia is a very strong company and they’ve been competing very aggressively against us for quite some time. Their agency program dates back to the acquisition of Venere, which is many years ago now. So, we think we’ve been doing a decent job in the phase of very robust competition from Expedia.”

As shown by the chart below, over the past three years, Priceline margins have increased while Expedia’s margins have actually narrowed. Of course, it must be noted that the reason why Priceline has significantly higher margins than Expedia is that Priceline focuses on the higher-margin hotel business where as Expedia focuses more on flights.

PCLN Operating Margin TTM data by YCharts

More on Expedia and Orbitz

After Priceline, Expedia is my next favorite name in the space. Currently, as shown by the chart below, Expedia is trading at historically high valuations. That being said, the valuation does not seem excessive when compared to Priceline. Like Priceline, Expedia also has a lot of cash on its balance sheet, currently more than $2 billion or $15.46 per share.

EXPE Forward PE Ratio data by YCharts

Orbitz is my least favorite name in the industry. Orbitz currently trades at 26 times forward earnings, more than both Priceline and Expedia. Orbitz has also proved the weakest company of the three as it has repeatedly swung from money-losing quarters to money-making quarters. Both Priceline and Expedia have been solidly profitable. I would not, however, bet against Orbitz or sell it short because I think the company is a possible takeover target. The online travel industry has seen many deals over the past few years and I would not be surprised to see Orbitz taken over at some point.

Conclusion

Despite Priceline’s remarkable run over the past decade, there are reasons why the stock can continue to rally. The reasonable valuation relative to historic norms, high short interest, and potential use of cash are all reasons why Priceline can continue to rally. After Priceline, my next favorite name in the industry is Expedia.

The article Near Its All-Time High, Priceline Can Continue to Rally originally appeared on Fool.com and is written by Sammy Pollack.

Sammy is a member of The Motley Fool Blog Network — entries represent the personal opinion of the blogger and are not formally edited.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.