Anadarko Petroleum Corporation (NYSE:APC)’s business in Mozambique has become something of a legend. That East African country ravaged by decades of civil war is now suddenly touted to be one of the world’s largest LNG producers. Mozambique’s riches and progress are because of Anadarko and its relentless efforts to dig deep into the Indian Ocean looking for oil and natural gas. In the same breath, Societe Generale announced their buy rating once again for the company. In this article, I will discuss how Anadarko’s consistent success in Mozambique will increase the company’s long-term value based on a discounted cash flow basis.

Anadarko’s success in Mozambique began when it announced a massive gas discovery in the Rovuma basin. The Prosperidade field is located 56 kilometers off Cabo Delgado coast and is expected to hold 17 trillion cubic feet of recoverable natural gas. The company states that the surrounding area can yield more than 30 trillion cubic feet of natural gas eventually. Apart from Prosperidade, Anadarko has also found petroleum resources in the 2.6 million acre Offshore Area 1. Another 20 exploration prospects and leads are waiting to be operationalized in adjoining areas. Anadarko also possesses an additional 3 million acres in Northern Mozambique, where it is using scientific and seismic technology to explore for oil and gas.

Anadarko holds a 36.5% stake in this particular area, while Empresa Nacional de Hidrocarbonetos holds a 15% stake.

Cove Energy, BPRL Ventures, Videocon, and Mitsui hold smaller shares. The enormous amount of natural gas that exists along the coast of Mozambique is almost entirely handled by Anadarko.

How Mozambique Could Impact Cash Flow by 2018

At the moment, all these ventures have been agreed upon and deals have been signed. Between 2014 and 2018, the company will fabricate facilities, drill development wells, install subsea architecture, secure shipping architecture, and evaluate expansion opportunities. The first sales and production will happen in 2018. The company expects 30 trillion cubic feet of natural gas at Cabo Delgado. The 30 trillion cubic feet of gas can be valued at $9 billion at the moment, with an average price of $3 per thousand cubic feet of natural gas. Platts reported that there will be a 54% increase in LNG prices by 2018. This means a thousand cubic feet of liquid natural gas will cost at least $5 in 2018. This would amount to $15 billion worth of natural gas that Anadarko can boast of in Mozambique. This will help Anadarko to increase its cash flow immensely.

Enersis Is the Only Competitor in Mozambique

The only competitor that the company has is Enersis S.A. (ADR) (NYSE:ENI). Recently it was reported that both Anadarko and Enersis will work together in a sort of cooperation that was facilitated by the Mozambican government. Anadarko has also invested in Mozambique’s infrastructure, building its railway lines, training its engineers, and constructing oil refineries. All these investments, both hard and soft, have ensured that Anadarko will be able to translate those capital investments into revenue by 2018. Anadarko plans to ship the first batch of LNG from Mozambique by 2018. By then, Mozambique will be the largest producer of natural gas after Australia and Qatar. Enersis’ chief executive, Paolo Scaroni,revealed in an interview that the company had spent 5 years studying East Africa. It had not found anything valuable until it won the blocks it wanted in Mozambique in 2006. Once it got the blocks it wanted off the coast of Mozambique, there was no looking back. Enersis continues to be the only major competitor for Anadarko and holds 70% of the Rovuma Basin fields.

Analysts Continue to Reiterate Anadarko as a ‘Buy’

Meanwhile, other analysts have recommended Anadarko’s shares to investors as well. Barclays Capital reissued an ‘overweight’ rating on Jan. 16, 2012. With a target price of $99, Barclays Capital recommends Anadarko shares to those who are interested in long-term benefits. Deutsche Bank has a ‘buy’ rating for Anadarko and has increased its target price from $86 to $95. Jags Report noted that more than 22 research analysts now have rated Anadarko as a definite buy. All these positive opinions about Anadarko will actually serve as a catalyst to the company’s stock performance. Anadarko’s stock will continue to be bought while its stock increases in its value. This snowball effect will ensure that Anadarko remains healthy and profitable in the long-term. I expect this trend to continue even after the first batch of LNG shipments is shipped across the world from Mozambique in 2018.

Anadarko’s Only Competitor in Mozambique is Enersis

Chevron Corporation (NYSE:CVX) sold all of its downstream assets in Mozambique to Engen in October 2011. These acquisitions continue to help Engen establish its presence in Mozambique. However, Chevron, a formidable American rival of Anadarko, lost quite a bit of action in Mozambique. If Chevron had stayed on in Mozambique and entered the exploration and drilling space, there would have been quite a bit of competition for both Anadarko and Enersis.

Chevron said fourth-quarter profits increased a whopping 41% to a record $7.25 billion due to stronger refining results and a boost from the Australian natural gas field swap. Chevron’s net income jumped to $3.70 a share from $2.58 in the same period in 2011.

Royal Dutch Shell plc (ADR) (NYSE:RDS.A) lost a deal in 2012 that would have allowed it to explore and drill in Mozambique. Shell’s exploration chief Andy Brown reiterated that the company is still interested in Mozambique’s gas bonanza and will make every effort to get a piece of the cake.

Total bought a 40% stake in a production contract for an undisclosed amount from Malaysia’s Petronas Gas bhd. The field is located off the coast of Mozambique, at Rovuma Basin. Total might be able to create a sort of competitive spirit among Enersis and Anadarko, which so far has remained collaborative.

Conclusion

Anadarko currently trades at $81 and has a market cap of $40 billion. With an enterprise value of $51 billion, it is one of the largest oil and natural gas companies in the world. The company’s price to sales ratio of 2.96 and price to book ratio of 1.95 are particularly impressive. With a profit margin of 13.64% and an operating margin of 8.73%, this stock will continue to be profitable in the long term. Anadarko is certainly one of the most valuable gas stocks at the moment. Like most analysts have stated, Anadarko will be a great long-term investment with regular dividends and benefits.

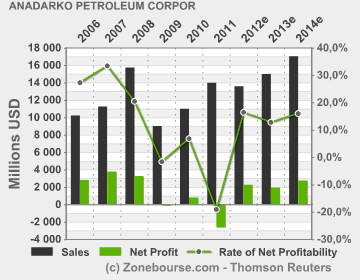

Rate of net profitability is likely to hit almost 20% by 2014

The projected revenue for 2018 is $23.5 billion, with a 4% growth rate. Analysts also note that Anadarko has a 45% cash flow potential with a potential price of $44. The projected gross profit for the year 2018 is $14 billion, which is roughly the value of LNG reserves in Mozambique in 2018. Though production has not begun yet, and the projects are still in the drilling stage, revenue and profit will soon help Anadarko’s cash flow increase.

The article Mozambique Solidifies Long-Term Cash Flow Position originally appeared on Fool.com and is written by Jordo Bivona.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.