In many industries, companies differentiate their products as a means to attract customers and justify higher prices. However, in commodity industries, the product is uniform and the price is set by the market. Therefore, the only way for companies to differentiate themselves is by becoming the lowest-cost producer — thereby enabling the company to earn higher margins than its peers.

Potash producers sell a commodity product. Therefore, market leaders like Mosaic Co (NYSE:MOS), Potash Corp./Saskatchewan (USA) (NYSE:POT), and Intrepid Potash, Inc. (NYSE:IPI) strive to cut costs as low as possible while maximizing capacity to take advantage of excess demand.

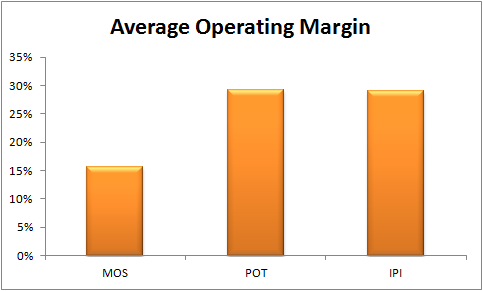

As the chart below shows, some companies achieve this goal better than others. While PotashCorp and Intrepid Potash average 30% operating margins, Mosaic Co (NYSE:MOS)’s operating margin is a little more than half of that.

Part of this can be explained by a bad first-half of the last decade for Mosaic, when it struggled to turn a profit in a difficult environment. However, the difference in profitability is better explained by cost structure differences between the firms.

Key differences

Although Mosaic is a vertically-integrated potash producer — it owns several phosphate rock mines — the company operates at a cost disadvantage to its competitors.

For instance, Potash Corp./Saskatchewan (USA) (NYSE:POT)’s Canadian mines are some of the least expensive mines in the world — the production cost is simply much lower than other mines due to differences in quality. This enables the company to produce more potash at a lower cost than Mosaic, giving it higher profitability.

Meanwhile, Intrepid Potash gains a cost advantage due to its positioning in the United States. Although the company’s mines are not as conducive to low-cost production as Potash Corp./Saskatchewan (USA) (NYSE:POT)’s Canadian mines, the company pays lower royalty rates to landowners than is typical in Canada.

In addition, Intrepid is committed to producing a portion of its potash using solar evaporation to generate energy, thereby reducing its cost of production even further.

Mosaic Co (NYSE:MOS), on the other hand, does not enjoy any of the cost advantages that enable its competitors to earn 30%+ operating margins. However, the benefit of operating in a commodity industry is that each company can essentially play its own game; the price of potash is not greatly affected by any one company’s decisions, so all companies must accept the market price. How profitable one company is compared to its peers does not have a significant effect on its long-term viability. In fact, a lower-margin company like Mosaic may represent better upside because it has significant room for improvement.