The market has been volatile due to elections and the potential of another Federal Reserve rate increase. Small cap stocks have been on a tear, as the Russell 2000 ETF (IWM) has outperformed the larger S&P 500 ETF (SPY) by more than 10 percentage points since the end of June. SEC filings and hedge fund investor letters indicate that the smart money seems to be getting back in stocks, and the funds’ movements is one of the reasons why small-cap stocks are red hot. In this article, we analyze what the smart money thinks of Metlife Inc (NYSE:MET) and find out how it is affected by hedge funds’ moves.

Metlife Inc (NYSE:MET) investors should be aware of a decrease in activity from the world’s largest hedge funds in recent months. There were 45 hedge funds in our database with MET holdings at the end of the previous quarter. At the end of this article we will also compare MET to other stocks including salesforce.com, inc. (NYSE:CRM), The Southern Company (NYSE:SO), and American Tower Corp (NYSE:AMT) to get a better sense of its popularity.

Follow Metlife Inc (NYSE:MET)

Follow Metlife Inc (NYSE:MET)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Keeping this in mind, we’re going to view the recent action encompassing Metlife Inc (NYSE:MET).

Hedge fund activity in Metlife Inc (NYSE:MET)

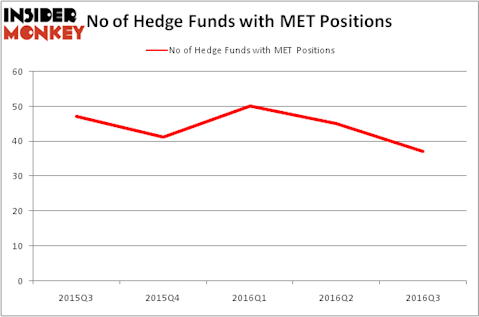

At the end of the third quarter, a total of 37 of the hedge funds tracked by Insider Monkey were bullish on this stock, a drop of 18% from the previous quarter. The graph below displays the number of hedge funds with bullish position in MET over the last 5 quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Ric Dillon’s Diamond Hill Capital has the biggest position in Metlife Inc (NYSE:MET), worth close to $314 million, accounting for 1.9% of its total 13F portfolio. Coming in second is Masters Capital Management, led by Mike Masters, holding a $311 million call position; the fund has 6.2% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions include Richard S. Pzena’s Pzena Investment Management, Peter Rathjens, Bruce Clarke and John Campbell’s Arrowstreet Capital and Cliff Asness’s AQR Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Now that we’ve mentioned the most bullish investors, let’s also take a look at some funds that got rid of their entire stakes in the stock during the third quarter. At the top of the heap, Clint Carlson’s Carlson Capital got rid of the largest position of all the investors studied by Insider Monkey, worth about $28.9 million in stock. Ken Griffin’s fund, Citadel Investment Group, also dumped its call options, worth about $25 million.

Let’s now take a look at hedge fund activity in other stocks – not necessarily in the same industry as Metlife Inc (NYSE:MET) but similarly valued. These stocks are salesforce.com, inc. (NYSE:CRM), The Southern Company (NYSE:SO), American Tower Corp (NYSE:AMT), and Ford Motor Company (NYSE:F). This group of stocks’ market valuations are closest to MET’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CRM | 66 | 2135618 | 6 |

| SO | 20 | 568071 | -1 |

| AMT | 48 | 2928784 | -1 |

| F | 32 | 683624 | 1 |

As you can see these stocks had an average of 42 hedge funds with bullish positions and the average amount invested in these stocks was $1.58 billion. That figure was $1.53 billion in MET’s case. salesforce.com, inc. (NYSE:CRM) is the most popular stock in this table. On the other hand The Southern Company (NYSE:SO) is the least popular one with only 20 bullish hedge fund positions. Metlife Inc (NYSE:MET) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard CRM might be a better candidate to consider taking a long position in.

Disclosure: none.