Last week, department store operators Macy’s, Inc. (NYSE:M) and Nordstrom, Inc. (NYSE:JWN) reported disappointing sales and earnings results for the recently ended second quarter. Furthermore, both companies lowered guidance for the full year. Macy’s, Inc. (NYSE:M) cut its fiscal year 2013 EPS guidance from a $3.90-$3.95 range to a $3.80-$3.90 range, while Nordstrom, Inc. (NYSE:JWN) reduced its fiscal year 2013 EPS guidance from a $3.65-$3.80 range to a $3.60-$3.70 range.

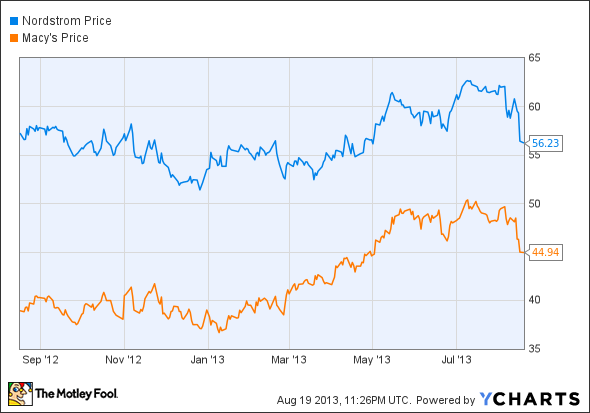

Macy’s vs. Nordstrom 1-Year Price Chart, data by YCharts.

As the chart shows, both stocks have experienced significant declines recently, due in part to their weak earnings. This has created good entry points for investors looking to take advantage of the long-term potential of these two businesses.

Macy’s hits a bump

Macy’s, Inc. (NYSE:M) has experienced a strong and steady recovery since the Great Recession. Same-store sales grew 4.6% in fiscal year 2010, 5.3% in 2011, and 3.7% in 2012. Macy’s, Inc. (NYSE:M) also achieved a same-store sales increase of nearly 4% in the first quarter this year. However, both total sales and same-store sales were down 0.8% in the second quarter.

On Macy’s, Inc. (NYSE:M) earnings call, CFO Karen Hoguet attributed last quarter’s weak sales to several factors. First, hot weather arrived late in much of the country, hurting sales of seasonal merchandise. Second, many consumers appear to be prioritizing capital purchases such as autos and housing over other discretionary spending this year. Third, Macy’s underemphasized “value” in its marketing messages during the second quarter.

None of the factors that dragged Macy’s down this quarter are “permanent.” Obviously, weather is unpredictable but not a real “threat” to the business, while consumer spending is likely to improve over time as the economy continues to recover. More important, Macy’s has addressed its messaging problem by refocusing on value both in its marketing and on the selling floor. Overall, Macy’s continues to operate a very healthy business.

Growth slows at Nordstrom

Unlike Macy’s, Inc. (NYSE:M), Nordstrom, Inc. (NYSE:JWN) kept same-store sales moving in the right direction with a 4.4% increase last quarter. However, a shift in the timing of Nordstrom’s Anniversary Sale had a 250-basis-point positive impact on sales; without that effect, same-store sales would have grown by 1.9%. In any case, Nordstrom, Inc. (NYSE:JWN)’s sales growth this year has been well below the impressive pace set in the last few years. Nordstrom grew same-store sales by 8.1% in fiscal year 2010, 7.2% in 2011, and 7.3% in 2012.

Nordstrom faced some of the same challenges as Macy’s last quarter. Executives noted that sales have missed projections this year as the cyclical upswing of the past three years has moderated. On the other hand, the Nordstrom Rack concept continues to perform well and direct (i.e., online) sales continued to grow rapidly. As a result, management seems very comfortable with their ambitious plans to grow over the next five years by doubling the number of Nordstrom, Inc. (NYSE:JWN) Rack stores, entering the Canadian market, and opening a Manhattan store.

Foolish bottom line

Macy’s, Inc. (NYSE:M) and Nordstrom may have had disappointing quarters, but they both have strong long-term prospects. As of Monday’s close, Macy’s trades for just under 12 times projected fiscal year 2013 earnings, while Nordstrom trades for just over 15 times projected earnings. Considering these reasonable valuations, both stocks seem attractive for long-term investors.

I find Nordstrom to be the more compelling investment case at this point. While it has a slightly higher earnings multiple, Nordstrom’s growth potential is much more significant. The rapid expansion of the Nordstrom Rack concept — as well as the slower growth of the full-line business — should lead to solid earnings growth through the end of the decade and beyond. Patient investors are likely to be rewarded with long-term stock appreciation.

The article Earnings Misses Create Buying Opportunities in These Retailers originally appeared on Fool.com and is written by Adam Levine-Weinberg.

Fool contributor Adam Levine-Weinberg has no position in any stocks mentioned. The Motley Fool has no position in any of the stocks mentioned.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.