For the past six months, I’ve been looking for an opportunity to put my money where my mouth is and add to my position in LinnCo LLC (NASDAQ:LNCO). Thanks to recent bear attacks, the stock has been knocked down to a pretty decent buy point. I took advantage of that recent weakness to double up on my position as the long-term story remains very much intact. I see two key reasons why now makes the perfect time to buy or add to a position in the company.

Transformational acquisition is closing soon

Earlier this year, LinnCo LLC (NASDAQ:LNCO), in conjunction with LINN Energy LLC (NASDAQ:LINE) announced the game-changing deal for Berry Petroleum Company (NYSE:BRY). The $4.3 billion deal, which is being delayed slightly, is still expected to close in the third quarter. Once it does, the fundamentals of LINN and by extension LinnCo will improve dramatically. Not only that but both companies will be boosting their respective investor payouts as well as shifting those payouts to a monthly schedule.

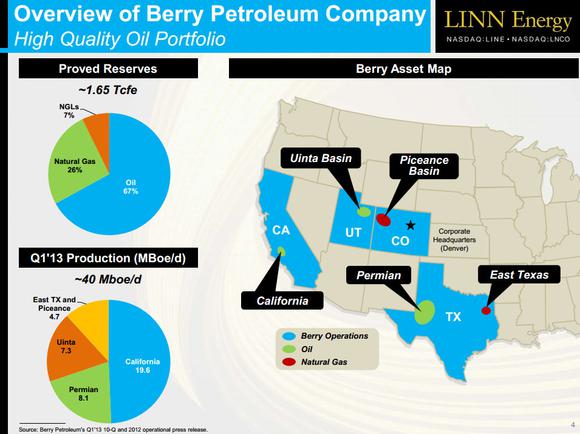

Berry Petroleum Company (NYSE:BRY) is a great fit for Linn Energy LLC (NASDAQ:LINE) and LinnCo LLC (NASDAQ:LNCO). Not only does it boost reserves by 34%, but these reserves are very liquids heavy with 75% being oil or NGLs. That will shift LINN’s reserve mix toward liquids, which will be 54% liquids and 46% natural gas. The deal also improves LINN’s credit metrics and its distributable cash flow, making this deal a huge winner for LINN. Finally, these are excellent low-decline, long-life assets that add to the company’s operations in California, Texas, and the Rockies, as you can see on the map below.

Source: LINN Energy investor presentation.

Deal market to heat up

While the Berry Petroleum Company (NYSE:BRY) deal helps improve Linn Energy LLC (NASDAQ:LINE) in both the immediate and long term, the company is always on the prowl for its next deal as it continues to consolidate mature oil and gas assets. I’m honestly surprised the company has yet to announce another acquisition as LINN and its peers have been very vocal that we should expect robust merger and acquisition activity. LINN’s only other transaction this year had the company on the selling end. That’s likely to change as the shale boom has opened up a large inventory of mature oil and natural gas basins, which leaves a huge opportunity for upstream MLPs to consolidate these assets.

Closing accretive transactions of mature assets is at the core of Linn Energy LLC (NASDAQ:LINE)’s business model. The Berry Petroleum Company (NYSE:BRY) transaction added more than $0.40 per unit to LINN’s distributable cash flow, which enabled the company to provide investors with a distribution boost of 6.2% while also significantly improving its coverage ratio. When upstream MLPs like LINN or peer BreitBurn Energy Partners L.P. (NASDAQ:BBEP) can find needle-moving deals, it can significantly add to the company’s distributable cash flow, leading to distribution increases. Breitburn, for example, will see a $0.21-per-unit accretion by closing $500 million worth of deals that fit its criteria this year. That will keep its 10% yield heading even higher.