A SWOT analysis is a look at a company’s strengths, weaknesses, opportunities, and threats, and is a tremendous way to gain a detailed and thorough perspective on a company and its future. As 2013 begins, I would like to focus on a steady natural gas exploration and acquisition company: Linn Energy LLC (NASDAQ:LINE).

Strengths:

1). Accelerated Revenue Growth: In 2009, Linn Energy reported revenue of $408 million; in 2011, the company announced revenue of $1.16 billion, representing year over year annual growth of 68.62%, a trend that is highly anticipated to sustain into the future with projections placing 2014 revenue at $2.78 billion. This growth has been due to acquisitions that have yielded significant returns.

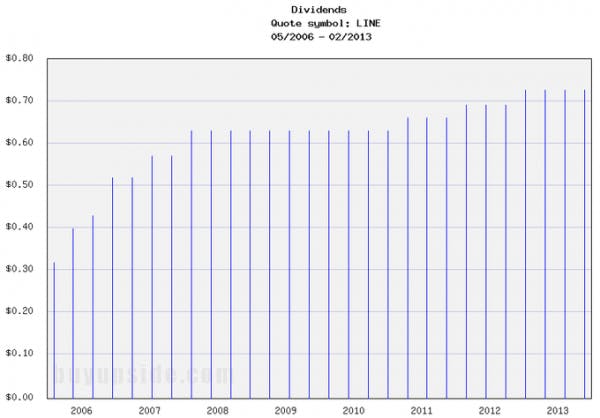

2). Massive Dividend: At the moment, Linn Energy pays out quarterly dividends of $0.73, which when annualized puts the dividend as yielding 7.79%

3). Double Digit Net Profit Margin: Currently, the company carries a net profit margin of 27.02%, representing a strong and profitable company primed for growth into the future

4). Relatively Low Volatility: Linn Energy currently holds a beta ratio of 0.68, representing a company trading with relatively low volatility, a major upside for long-term investors

5). Relatively Low Price to Book Ratio: Linn Energy presently withholds a price to book ratio of 1.93, which presents investors with an ideal entry point

Weaknesses:

1). Net Debt: The company possesses $1.15 million of cash and cash equivalents on their balance sheets, but their debt load of $6.84 billion results in a massive net debt for the company, a major downside to the business

2). Fluctuating Profit: Over the past years the company has swung from a $826 million net profit in 2008 to a -$296 million net loss in 2009, back to a $438 million net profit in 2011, and this inconsistency in profits is a major downside for investors as it creates uncertainty

3). Lack of Institutional Confidence: Only 25.58% of shares outstanding are held by institutional investors, displaying the lack of confidence some of the largest investors in the world have in the company and its future

4). Growth in Operating Expenses: Over the past five years, Linn Energy’s revenue has grown 13.06%, while operating expenses have grown 86.50%, representing margin contraction, a troubling sign for a company

Opportunities:

1). Dividend Growth: Since implementing their dividend program in 2006, Linn Energy has consistently raised their dividend payouts, a trend that is highly anticipated to sustain into the future as free cash flow becomes more abundant

2). Acquisitions: The company has a long history of acquiring property and other companies and successfully yielding natural gas from these acquisitions, with the most recent coming in December 2011, and further acquisitions could introduce inorganic growth to the company and reward shareholders

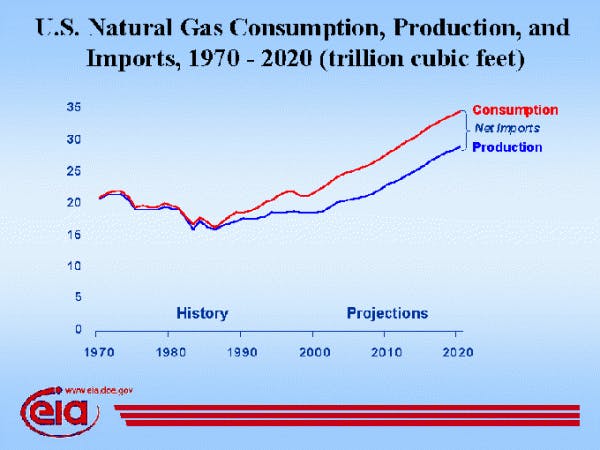

3). Innovative Technologies: Innovative technologies have been introduced over the past several years that have multiplied natural gas production rates, and opened reserves of natural gas that could never be reached before, and further introduction of innovative technologies could substantially help Linn

4). Growth in Demand for Natural Gas: Growth in the demand for natural gas could drive strength in natural gas prices, which could increase Linn Energy’s margins

Threats:

1). Continuation of Weakness in the Natural Gas Market: Since 2008, natural gas prices have fallen from nearly $14, to the current level sitting under $4, and a continuation of weakness in the natural gas market could severely hurt the company and strain their margins

2). Government Regulation: Controversial exploration methods for natural gas, such as fracking, have faced severe government regulation, and any further regulation passed down by Washington could cripple the company’s ability to increase its production level and find new reserves

3). Competition: The competition to acquire quality properties that offer substantial potential is extremely fierce, and the competition to acquire new property can lead to Linn Energy overpaying for property that does not produce what is expected

Competition:

Major publicly traded competitors of Linn Energy include Anadarko Petroleum Corporation (NYSE:APC), Chevron Corporation (NYSE:CVX), Devon Energy Corporation (NYSE:DVN), and ConocoPhillips (NYSE:COP) . All of these companies operate in the same industry as Linn and compete with the company to acquire new property. Anadarko is valued at $42.20 billion, pays out a dividend yielding 0.43%, and carries a price to earnings ratio of 17.80. Chevron is valued at $226.33 billion, pays out a dividend yielding 3.11%, and carries a price to earnings ratio of 8.68. Devon is valued at $24.47 billion, pays out a dividend yielding 1.32%, and carries a price to earnings ratio of 34.86. ConocoPhillips is valued at $70.25 billion, pays out a dividend yielding 4.56%, and carries a price to earnings ratio of 9.80.

The Foolish Bottom Line:

Financially, Linn Energy is relatively solid. The company possesses a business model producing a double digit net profit margin, accelerated revenue growth, and a relatively cheap valuation. However, the company carries fluctuating profit and a massive debt load. Above all, the company’s enormous dividend and ability to continually raise their dividend payouts provides immense opportunity to investors, and over the long-term, Linn appears to be a company primed to provide solid returns through all economic cycles.

The article A Steady Energy Company Doling out Nearly 8% originally appeared on Fool.com and is written by Ryan Guenette.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.