The 700+ hedge funds and money managers tracked by Insider Monkey have already compiled and submitted their 13F filings for the third quarter, which unveil their equity positions as of September 30. We went through these filings and identified the changes in hedge fund positions. Our extensive review of these public filings is finally over, so this article is set to reveal the smart money sentiment towards Lindblad Expeditions Holdings Inc (NASDAQ:LIND).

Lindblad Expeditions Holdings Inc (NASDAQ:LIND) shareholders have witnessed a decrease in activity from the world’s largest hedge funds lately. There were 13 hedge funds in our database with LIND holdings at the end of the second quarter, 2 more than there were a quarter later. At the end of this article we will also compare LIND to other stocks including DXP Enterprises Inc (NASDAQ:DXPE), AAC Holdings Inc (NYSE:AAC), and Genesis Healthcare Inc (NYSE:GEN) to get a better sense of its popularity.

Follow Lindblad Expeditions Holdings Inc. (NASDAQ:LIND)

Follow Lindblad Expeditions Holdings Inc. (NASDAQ:LIND)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Rawpixel/Shutterstock.com

How are hedge funds trading Lindblad Expeditions Holdings Inc (NASDAQ:LIND)?

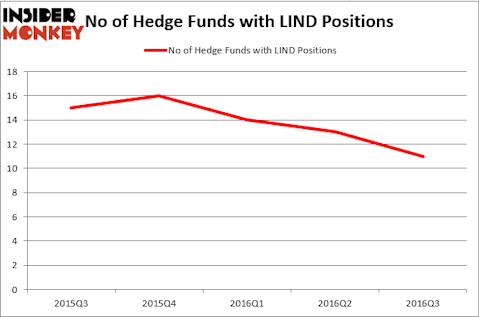

At the end of the third quarter, a total of 11 of the hedge funds tracked by Insider Monkey were long this stock, a 15% fall from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards LIND over the last 5 quarters, which has steadily declined in 2016. With the smart money’s positions undergoing their usual ebb and flow, there exists a select group of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, Three Corner Global Investors, led by Gunnar Overstrom, holds the largest position in Lindblad Expeditions Holdings Inc (NASDAQ:LIND). Three Corner Global Investors has a $9.5 million position in the stock, comprising 3.6% of its 13F portfolio. The second most bullish fund manager is Gratia Capital, led by Steve Pei, which holds a $7.3 million position; the fund has 2.4% of its 13F portfolio invested in the stock. Some other hedge funds and institutional investors that hold long positions consist of Chuck Royce’s Royce & Associates, Richard McGuire’s Marcato Capital Management, and Andrew Feldstein and Stephen Siderow’s Blue Mountain Capital. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds, which is based on the performance of their 13F long positions in non-micro-cap stocks.