Investors love a good restaurant story and are paying high prices for Chuy’s Holdings Inc (NASDAQ:CHUY). Chuy’s stock is trading near its 52-week high and at crazy-high valuations. Chipotle Mexican Grill, Inc. (NYSE:CMG), Panera Bread Co (NASDAQ:PNRA), and BJ’s Restaurants, Inc. (NASDAQ:BJRI) have all been objects of market love and all have traded at extreme valuations at one time or another. Chuy’s is at the top of the valuation ladder. Maybe it deserves to be there, but on some metrics, it doesn’t measure up.

The Chuy’s Holdings Inc (NASDAQ:CHUY) love story started in July 2012 with its IPO. It closed 16% above its offering price the first day of trading and has never looked back.

Meet Chuy’s

I love the catchphrase, “If you’ve seen one Chuy’s, you’ve seen one Chuy’s”– that underscores their unique one-of-a kind restaurants. It is a fast casual Mexican food concept specializing in enchiladas, tacos, burritos, and fajitas all served with signature sauces. The interiors are bright and described as irreverent with Mexican folk art pieces hand-carved and colorful. There are metal palm trees and a car trunk that serves as the Nacho Bar.

It averages 400,000 customers per store per year. Chipotle Mexican Grill, Inc. (NYSE:CMG) traffic per store per year is about half Chuy’s Holdings Inc (NASDAQ:CHUY) but it does have 1,450 stores compared to 41 stores for Chuy’s. The store count increased from just eight units in 2007 to 41 – a four-fold jump.

Investors will pay extraordinary prices for growth and the perception that growth is infinitely sustainable. Chuy’s Holdings Inc (NASDAQ:CHUY) has remarkable growth in revenue and earnings and the story looks as irresistible as a plate of crispy nachos and guacamole.

Some numbers

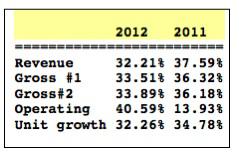

*Operating growth is artificially high in 2013 benefitting from a one-time $2 million charge in 2012 that depressed operating income. Operating income in 2013 would have decreased — more reflective of higher expenses and slowing revenue.

In 2012, revenue growth matched store growth indicating that revenue per store is not increasing substantially—a fact borne out by flat average unit volumes (AUVs). In the first quarter of 2013, revenue growth lagged unit growth by nearly 8%. AUV shrank year-over-year by 3% and same store sales were 2.3% compared to 2.6% in the first quarter of 2012.

Even though revenue growth looks impressive, it is largely the product of new stores opening and increasing dollars per check spent. Same store sales are low single-digit and average unit volumes are declining. Both of these measures point to growth that may not be worthy of the high share price.

The competition

For comparison, Chipotle Mexican Grill, Inc. (NYSE:CMG) generally sees revenue growth far in excess of its store count growth. And that’s made possible by incomparable comps and ever-increasing average volume per store — the kind of growth story that deserves to trade at premium valuations.

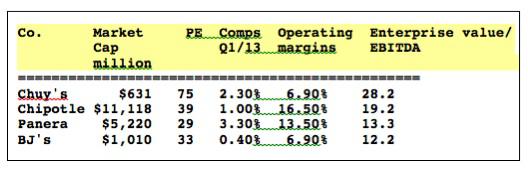

How does Chuy’s Holdings Inc (NASDAQ:CHUY) stack up against some other restaurant chains?

Chuy’s operating margins cannot compete with Panera Bread Co (NASDAQ:PNRA) and Chipotle. If we adjust for the extra one-time charge in 2012, we see their margins decreased roughly 4% year-over-year, in line with declining revenue and increasing costs. With a PE of 75 and EV/EBITDA at 28.2X, it sells at premiums well above other restaurant growth stories. Is its growth worth that much more?

Chipotle and Panera Bread Co (NASDAQ:PNRA) have had long runs of growth in the high teens and mid-20% range with unit increases contributing only about half of total growth. Same store sales and increasing unit volumes created the rest. This is a more convincing growth story than relying on store count for higher revenue.

For Chuy’s Holdings Inc (NASDAQ:CHUY), most of its revenue growth comes from adding restaurants. AUV’s were flat in 2011 and 2012 and declined in the most recent quarter. This is a sign of weakening consumer demand since check prices have increased.