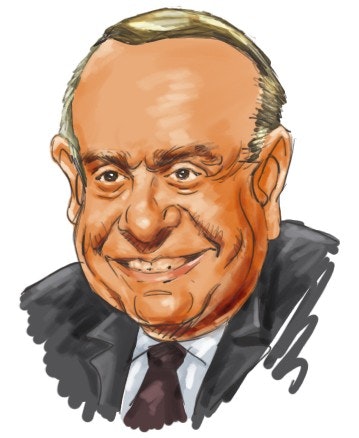

Leon Cooperman is the Chairman and CEO of Omega Advisors, a hedge fund with approximately $6 billion in assets under management. Prior to founding Omega in 1991, Cooperman was the Chairman and CEO of Goldman Sachs Asset Management. According to Forbes, Cooperman is the 242th richest American with a net worth of $1.8 billion.

Recently, Omega Advisors released its latest holdings in a 13F filing. Let’s take a closer look at the most bullish bets of the fund and decide whether investors should imitate these stock picks.

El Paso Corp (EP): During the fourth quarter, Cooperman increased his EP stakes by 26%. As of December 31, 2011, Omega had $138 million invested in EP. The company announced in October that Kinder Morgan Inc (KMI) had signed an agreement to acquire all of its outstanding shares for a total of $21.1 billion, or $29.15 per share. The transaction is expected to be completed in the second quarter this year.

Investing in takeover candidate is not easy. In “You Can Be A Stock Market Genius”, Joel Greenblatt explained the risks in merger arbitrage. Greenblatt said that the merger deal may fail to go through because of several reasons, such as regulatory problems and financing problems. The takeover candidate’s price may fall back to its pre-deal price or even lower. As a result, those who invest in the candidate will suffer big losses. Hedge funds have access to lawyers and other experts who are able to help them to judge whether the mergers will go through or not. Therefore, we think focusing on hedge funds’ merger arbitrage plays is a good strategy for ordinary investors. As always, investors need to be diversifies to protect themselves from unexpected losses.

We think EP is a good candidate because there were many hedge funds bullish about it. At the end of the third quarter, there were 35 hedge funds with EP positions in their 13F portfolios. For example, the most bullish hedge fund manager about EP was Carl Icahn. Icahn Capital LP had over $1 billion invested in this stock at the end of September. Barry Rosenstein, Dan Loeb, and Eric Mindich were also bullish about EP. The stock closed at $27.16 per share on February 17th, about 7% below the merger price offered by KMI.

McGraw-Hill Companies Inc (MHP): Cooperman also increased his MHP stakes by nearly 30% over the fourth quarter. At the end of last year, his Omega Advisors reported owning $130 million worth of MHP shares. Besides Omega, there were another 25 hedge funds with MHP positions in their 13F portfolios at the end of the third quarter. Barry Rosenstein was the most bullish hedge fund manager about MHP. His Jana Partners had more than $400 million invested in MHP at the end of September. MHP is expanding rapidly. The company spent approximately $200 million on acquisitions over the first three quarters last year. We are also favorable about the company’s growing net income and revenue, expanding profit margins, and reasonable debt levels. MHP is also trading at attractive multiples. It has a forward P/E ratio of 12.68 and its EPS is expected to grow at 10.50% on the average per year in the next five years. This indicates that MHP has a 2014 P/E ratio of 10.38 which is very reasonable.

A few other large positions in Omega’s portfolio include SLM Corp (SLM), Atlas Pipeline Partners LP (APL), and Linn Energy LLC (LINE). Cooperman reduced his stakes in these positions over the fourth quarter. These three stocks seem attractive too. Both APL and LINE have high dividend yields. APL has a dividend yield of 6.17% and LINE’s dividend yield is 7.49%. SLM also has a decent dividend yield of 3.13%. We think these dividend stocks are great alternatives to long-term treasury bonds, which yield around 2%. Additionally, SLM has a low forward P/E ratio of 7.30 and its EPS is expected to grow at 10% per year in the next five years. The stock pays investors over 150% as much as 10-year Treasuries while investors wait for its multiple to expand significantly.