Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

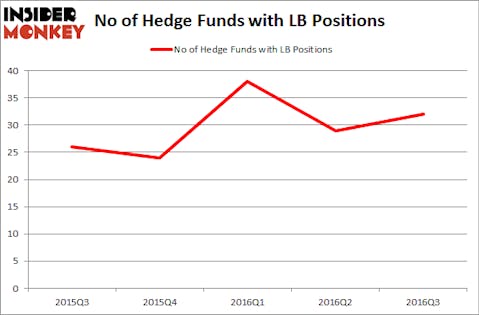

In this article, we are going to discuss the hedge fund sentiment towards L Brands Inc (NYSE:LB). At the end of September, there were 32 funds tracked by Insider Monkey long the stock, up from 29 funds a quarter earlier. At the end of this article we will also compare LB to other stocks including JD.Com Inc (ADR) (NASDAQ:JD), Cummins Inc. (NYSE:CMI), and TELUS Corporation (USA) (NYSE:TU) to get a better sense of its popularity.

Follow Bath & Body Works Inc. (NYSE:BBWI)

Follow Bath & Body Works Inc. (NYSE:BBWI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

wavebreakmedia/Shutterstock.com

Now, we’re going to go over the new action surrounding L Brands Inc (NYSE:LB).

How have hedgies been trading L Brands Inc (NYSE:LB)?

During the third quarter, the number of investors tracked by Insider Monkey long L Brands went up by 10% to 32. With the smart money’s positions undergoing their usual ebb and flow, there exists a few key hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to publicly available hedge fund and institutional investor holdings data compiled by Insider Monkey, Lansdowne Partners, managed by Alex Snow, holds the largest position in L Brands Inc (NYSE:LB). Lansdowne Partners has a $791.4 million position in the stock, comprising 6.8% of its 13F portfolio. Coming in second is Abrams Bison Investments, led by Gavin M. Abrams, holding a $220.1 million position; the fund has 24% of its 13F portfolio invested in the stock. Other professional money managers with similar optimism comprise Murray Stahl’s Horizon Asset Management, John Overdeck and David Siegel’s Two Sigma Advisors, and Phill Gross and Robert Atchinson’s Adage Capital Management.