Fisher Asset Management had 514 securities in its 13F portfolio valued at $36.1 billion at the end of September. Below I’ve compiled a list of Ken Fisher’s high-dividend stock picks from Fisher Asset Management’s most recent 13F filing. Ken Fisher’s past 13F filings are listed on Insider Monkey. I required a minimum dividend yield of 4% and Fisher Asset Management to hold a more than $25 million position in each stock in my list. I obtained 10 year market summary from Morningstar and all other market data from Finviz.

| Stock | Market Cap (Billion $) | Industry | Dividend Yield | P/E | Payout Ratio | Profit Margin |

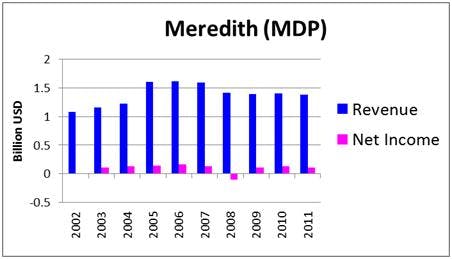

| Intel (INTC) | 103.5 | Semiconductor – Broad Line | 4.3% | 9.1 | 39.1% | 22.1% |

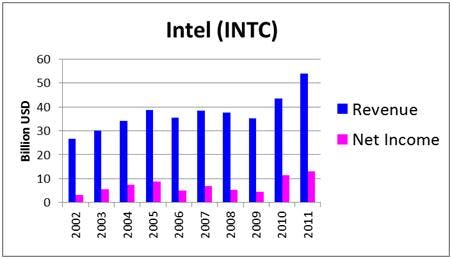

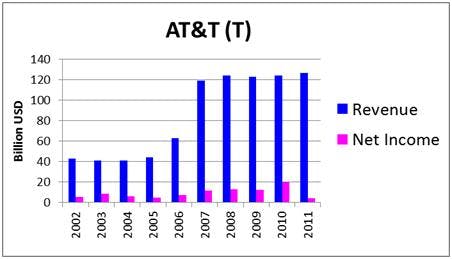

| AT&T (T) | 191.4 | Telecom Services – Domestic | 5.3% | 43.6 | 231.1% | 3.7% |

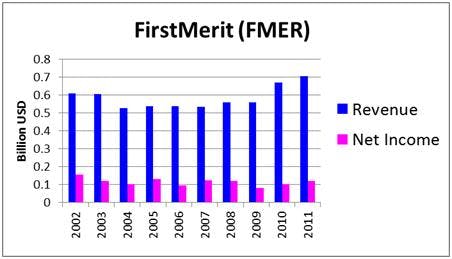

| FirstMerit (FMER) | 1.5 | Regional – Midwest Banks | 4.7% | 11.8 | 55.5% | 18.1% |

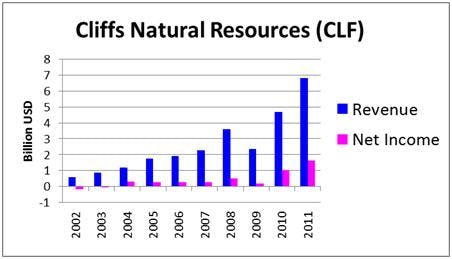

| Cliffs Natural Resources (CLF) | 5.2 | Steel & Iron | 6.9% | 5.7 | 39.3% | 16.3% |

| Altria (MO) | 63.8 | Cigarettes | 5.6% | 16.4 | 91.8% | 16.0% |

| Avista (AVA) | 1.4 | Diversified Utilities | 4.9% | 15.3 | 75.0% | 6.0% |

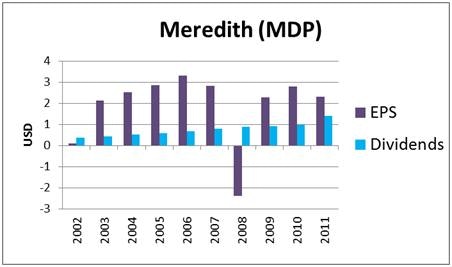

| Meredith (MDP) | 1.4 | Publishing – Periodicals | 4.8% | 13.3 | 63.8% | 7.7% |

Intel Corporation (NASDAQ:INTC) provides integrated digital technology platforms worldwide. Intel has been dominating the PC microprocessor market for the last two decades. Intel recently announced its newest chip, namely Itanium 9500, which offers twice the power of its predecessor while using less power. Early in this year Intel announced its re-entry into the smartphone market. Currently there are only six smartphones using Intel’s processors. Research firm Gartner estimates worldwide media tablet sales to increase by 98% to total 118.9 million units in 2012 compared to the previous year. The success in smartphone and tablet processor market will determine the future growth of INTC. Shares of INTC recently traded at $20.8 with a trailing price to earnings of 9.08 and a forward price to earnings of 10.56. INTC has a 4.33% dividend yield and lost 13.04% during the past 12 months. Intel has grown dividends at 6.5% annually over the last five years. The stock has a market cap of $103.5 billion and total debt/equity ratio of 0.15. INTC had an average annual EPS growth rate of 22.76% during the last five years. Fisher had $442 million invested in INTC shares. Paul Ruddock’s Lansdowne Partners holds the largest position in INTC with its $539 million investment at the end of June. Jim Simons also had $453 million invested in INTC shares.

AT&T Inc. (NYSE:T) provides telecommunications services worldwide. The company pays the highest dividend yield among the Dow 30 index constituents. It has paid uninterrupted dividends since 1893. Shares of T recently traded at $33.54 with a trailing price to earnings of 43.56 and a forward price to earnings of 12.95. T has a 5.25% dividend yield and gained 20% during the past 12 months. While the company’s EPS contracted at an average annual rate of nearly 19% per year over the past five years, its dividends increased at an average annual rate of 5.3% over the same period. The stock has a market cap of $191.4 billion and total debt/equity ratio of 0.63. Fisher had $279 million invested in T shares. Donald Chiboucis’s Columbus Circle Investors initiated a $191 million brand new position in T during the second quarter of 2012. Phill Gross hold the largest position in T with his $290 million investment athe the end of June.

Firstmerit Corp (NASDAQ:FMER) provides various banking, financial, insurance, and investment services. FirstMerit reported its 54th consecutive quarter of profitability by earning $35 million, or $1.36 per share, during the third quarter of 2012. FMER shares lost 23% from the time that it announced that it was acquiring fellow Midwestern bank Citizens Republic Bancorp, Inc. (NASDAQ:CRBC) on Sep 12, 2012. This compares with $30.6 million for the second quarter 2012 and $31.7 million for the third quarter 2011. Shares of FMER recently traded at $13.52 with a trailing price to earnings of 11.76 and a forward price to earnings of 10.82. FMER has a 4.73% dividend yield and lost 3.7% during the past 12 months. The stock has a market cap of $1.5 billion and total debt/equity ratio of 0.7. FMER had an average annual EPS growth rate of -1.21% during the last five years. Fisher had $45 million invested in FMER shares.

Cliffs Natural Resources Inc (NYSE:CLF) is a mining and natural resources company. Shares of CLF recently traded at $36.44 with a trailing price to earnings of 5.69 and a forward price to earnings of 9.51. CLF has a 6.86% dividend yield and lost 46.67% during the past 12 months. The stock has a market cap of $5.2 billion and total debt/equity ratio of 0.61. CLF had an average annual EPS growth rate of 34.9% during the last five years. Fisher had $34 million invested in CLF shares.

Altria Group, Inc. (NYSE:MO) provides cigarettes, smokeless products, and wine worldwide. The company is primarily a producer of tobacco products, whose famous brands include Marlboro, Basic, L&M, and Parliament. The company also has a nearly 30% stake in brewer SABMiller. Shares of MO recently traded at $31.48 with a trailing price to earnings of 16.4 and a forward price to earnings of 13.28. MO has a 5.59% dividend yield and gained 19.97% during the past 12 months. The stock has a market cap of $63.8 billion and total debt/equity ratio of 3.59. MO had an average annual EPS growth rate of 1.6% during the last five years. Fisher had $33 million invested in MO shares. The stock is popular with fund managers Phill Gross and Robert Atchinson of Adage Capital Management and Cliff Asness.

Avista Corp (NYSE:AVA) is an energy company operating the United States and Canada. Shares of AVA recently traded at $23.88 with a trailing price to earnings of 15.31 and a forward price to earnings of 13.65. AVA has a 4.86% dividend yield and gained 0.17% during the past 12 months. The stock has a market cap of $1.4 billion and total debt/equity ratio of 1.14. AVA had an average annual EPS growth rate of 3.27% during the last five years. Fisher had $27 million invested in AVA shares.

Meredith Corporation (NYSE:MDP) is a media and marketing company. Shares of MDP recently traded at $31.69 with a trailing price to earnings of 13.26 and a forward price to earnings of 11.74. MDP has a 4.83% dividend yield and gained 20.27% during the past 12 months. The stock has a market cap of $1.4 billion and total debt/equity ratio of 0.51. MDP had an average annual EPS growth rate of -7.7% during the last five years. Fisher had $26 million invested in MDP shares. Chuck Royce’s Royce & Associates hold the largest position in MDP with its $89 million investment at the end of June.