The ending effect of investors shifting their funds into equity markets is that year-over-year returns catapult. Stocks rebound easily from their bottomed out price in the prior year when investors move into the equity markets, but this makes it more difficult for equities to continue to overachieve moving forward. In order to continue to beat the benchmarks in the back half of a bull market, Fisher believes you don’t have to look for the sexy stock picks. Instead, it is better to have a diversified portfolio of mega-cap stocks with high market caps greater than, let’s say, $80 billion.

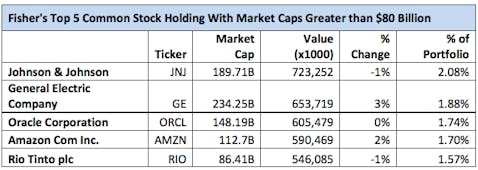

Fisher’s actions are louder than his words. Looking at the last 13-F filed by Fisher Asset Management, only two of his top ten common stock holdings have market caps under $80 billion. The table above shows his top five holdings with mega-sized market caps. The world’s largest and most diverse health-care company Johnson & Johnson (NYSE:JNJ) is Fisher’s largest common stock holding and accounts for 2.08% of his holdings (see why Barton Biggs likes Johnson and Johnson).

With products ranging from aircraft engines, to consumer financing, to industrial products, General Electric Company (NYSE:GE) is the second largest common stock holding accounting for 1.88% of Fisher’s portfolio. Oracle Corporation (NASDAQ:ORCL), the enterprise software company, is the third largest common stock holding accounting for 1.74% of his portfolio (Click here to see an earnings analysis for Oracle). Amazon.com, Inc. (NASDAQ:AMZN), the price focused convenient retail website, represents 1.70% of Fisher’s portfolio and is his fourth largest common stock holding. Rio Tinto plc (NYSE:RIO), the Australian diversified mining company, is the fifth largest common stock holding with a market cap greater than $80 billion, representing 1.57% of his portfolio.

Fisher still sees a lot of skepticism in the market, hinting that there are still opportunities for high returns. As we get closer to the back half of a bull market, Fisher’s insight on owning mega-caps can be helpful. Fisher stated right now is a good time to start buying these blue chips.

In the CNBC interview, Fisher didn’t point to any single mega-cap stock to own. Referring to his strategy with choosing mega caps in the back half of a bull market, he stated “I did that through the later ’90s and people thought I was stupid because they wanted to pick exciting stocks. The fact of the matter is, normally in the back of bull markets, any half of the stocks that are bigger than the dollar-weighted average cap of the market, beat the market. It’s a real simple game, and stock-picking mostly works against you.”

For a complete look at Ken Fisher’s top stock picks, continue reading on the fund manager’s Insider Monkey profile page.