Mortgage rates spiked hard last week, and great was the lamentation.

Over the seven days running from June 20 to June 27, mortgage analysts at Freddie Mac clocked 30-year mortgages running up 53 basis points, from 3.93% to 4.46%. That’s a 13.5% increase, for anyone who’s counting. As one commenter on our site complained: “I am buying a house in San Diego and my doofus mortgage broker did not lock my rate as advertised 6/11/2013. We are 3 weeks into escrow and [our mortgage will cost] $200 per month higher than 2 weeks ago!”

Over the course of a year, if rates keep rising so quickly, it could work out to an eightfold increase. One year from today, homebuyers would be paying upwards of 31% to own a piece of the American dream.

But don’t panic.

First, it’s generally a bad idea to extrapolate one week’s news into what might happen a full year from now. Ben Bernanke doesn’t hold press conferences every week of the year, after all. It’s unlikely that last week’s panicked price-move will repeat, and almost a dead certainty it won’t repeat … repeatedly.

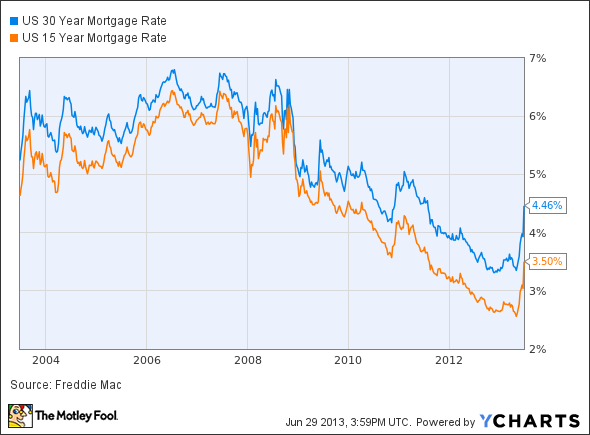

Second, if you think mortgages cost a lot today, well … they do. At least as compared with what they cost a week ago. But a bit of perspective is in order. Check out how today’s “expensive” mortgages compare with what people paid for similar mortgages over the past 10 years:

US 30 Year Mortgage Rate data by YCharts

As you can see, mortgages now cost roughly what they cost two summers ago. That’s two years of rate-cuts that have vanished, true. But you’re still paying only about 4.5% for a traditional 30-year fixed-rate mortgage, or FRM, today. That’s about a 30% discount off the prices people had to pay back in the middle of the Housing Bubble of the mid-2000s.

Fifteen-year FRMs are even cheaper. At 3.5% on average, they cost close to 40% less than their Bubble era prices. And costing nearly a full percentage point less than a 30-year FRM, they’re about as big a bargain (relative to the 30-year cost) as we’ve ever seen, historically.

And another thing

Sound good? It gets better. Pull back a step, and let’s expand our view and see what rates looked like over a longer period of history:

US 30 Year Mortgage Rate data by YCharts

So what you see here is that as recently as the mid-’80s — just one 30-year-mortgage ago — people were paying literally four times what they’re paying for a 30-year FRM today.

Foolish takeaway

So what does this mean to you? Well, if you’re in the market to buy a new home, or have been sitting on the fence, waiting to refinance a high(er)-cost mortgage, it means there’s still no time like the present to get started.