You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

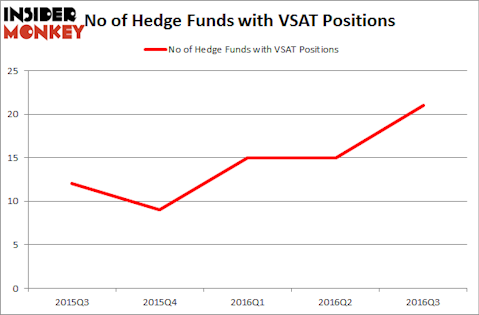

ViaSat, Inc. (NASDAQ:VSAT) was in 21 hedge funds’ portfolios at the end of September. VSAT has seen an increase in support from the world’s most successful money managers of late. There were 15 hedge funds in our database with VSAT positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as HEALTHSOUTH Corp. (NYSE:HLS), Leidos Holdings Inc (NYSE:LDOS), and ONE Gas Inc (NYSE:OGS) to gather more data points.

Follow Viasat Inc (NASDAQ:VSAT)

Follow Viasat Inc (NASDAQ:VSAT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Hedge fund activity in ViaSat, Inc. (NASDAQ:VSAT)

Heading into the fourth quarter of 2016, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, an increase of 40% from one quarter earlier. The graph below displays the number of hedge funds with bullish position in VSAT over the last 5 quarters. With the smart money’s sentiment swirling, there exists a few notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Baupost Group, led by Seth Klarman, holds the largest position in ViaSat, Inc. (NASDAQ:VSAT). Baupost Group has a $860.9 million position in the stock, comprising 12.2% of its 13F portfolio. Sitting at the No. 2 spot is Southeastern Asset Management, led by Mason Hawkins, which holds a $342.8 million position; 3.3% of its 13F portfolio is allocated to the stock. Other hedge funds and institutional investors that hold long positions comprise Bob Peck and Andy Raab’s FPR Partners, Bain Capital’s Brookside Capital and Jeffrey Bronchick’s Cove Street Capital. We should note that Southeastern Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As one would reasonably expect, key money managers were breaking ground themselves. Cove Street Capital created the most outsized position in ViaSat, Inc. (NASDAQ:VSAT). Cove Street Capital had $46.5 million invested in the company at the end of the quarter. Robert Pitts’ Steadfast Capital Management also made a $28 million investment in the stock during the quarter. The following funds were also among the new VSAT investors: Jim Simons’ Renaissance Technologies, George McCabe’s Portolan Capital Management, and Ken Griffin’s Citadel Investment Group.

Let’s also examine hedge fund activity in other stocks – not necessarily in the same industry as ViaSat, Inc. (NASDAQ:VSAT) but similarly valued. We will take a look at HEALTHSOUTH Corp. (NYSE:HLS), Leidos Holdings Inc (NYSE:LDOS), ONE Gas Inc (NYSE:OGS), and Endo Health Solutions Inc (NASDAQ:ENDP). This group of stocks’ market caps resemble VSAT’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HLS | 22 | 543448 | -3 |

| LDOS | 27 | 644414 | 1 |

| OGS | 11 | 66906 | -1 |

| ENDP | 32 | 797272 | -4 |

As you can see these stocks had an average of 23 hedge funds with bullish positions and the average amount invested in these stocks was $513 million. That figure was $1.88 billion in VSAT’s case. Endo Health Solutions Inc (NASDAQ:ENDP) is the most popular stock in this table. On the other hand ONE Gas Inc (NYSE:OGS) is the least popular one with only 11 bullish hedge fund positions. ViaSat, Inc. (NASDAQ:VSAT) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard ENDP might be a better candidate to consider taking a long position in.

Disclosure: None