Before we spend days researching a stock idea we’d like to take a look at how hedge funds and billionaire investors recently traded that stock. S&P 500 Index returned about 7.6% during the last 12 months ending November 21, 2016. Most investors don’t notice that less than 49% of the stocks in the index outperformed the index. This means you (or a monkey throwing a dart) have less than an even chance of beating the market by randomly picking a stock. On the other hand, the top 30 mid-cap stocks among the best performing hedge funds had an average return of 18% during the same period. Hedge funds had bad stock picks like everyone else. We are sure you have read about their worst picks, like Valeant, in the media over the past year. So, taking cues from hedge funds isn’t a foolproof strategy, but it seems to work on average. In this article, we will take a look at what hedge funds think about U.S. Bancorp (NYSE:USB).

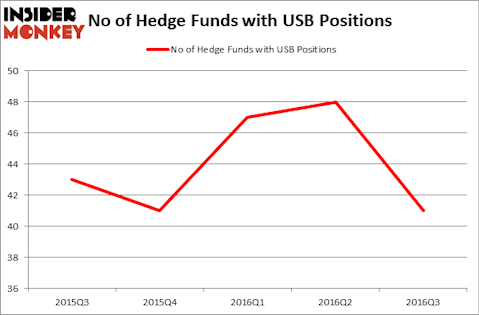

U.S. Bancorp (NYSE:USB) shareholders have witnessed a slight decrease in support from the world’s most elite money managers lately. At the end of September, 41 funds from our database held shares of the company, compared to 48 funds a quarter earlier. Nevertheless, the level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Danaher Corporation (NYSE:DHR), Costco Wholesale Corporation (NASDAQ:COST), and BHP Billiton plc (ADR) (NYSE:BBL) to gather more data points.

Follow Us Bancorp (NYSE:USB)

Follow Us Bancorp (NYSE:USB)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Kevin George/Shutterstock.com

Keeping this in mind, let’s analyze the recent action surrounding U.S. Bancorp (NYSE:USB).

What have hedge funds been doing with U.S. Bancorp (NYSE:USB)?

At the end of the third quarter, a total of 41 of the hedge funds tracked by Insider Monkey held long positions in U.S. Bancorp, down by 15% from one quarter earlier. With hedge funds’ capital changing hands, there exists a select group of notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Berkshire Hathaway, managed by Warren Buffett, holds the number one position in U.S. Bancorp (NYSE:USB). Berkshire Hathaway has a $3.6484 billion position in the stock, comprising 2.8% of its 13F portfolio. On Berkshire Hathaway’s heels is Donald Yacktman’s Yacktman Asset Management, which holds a $298.3 million position; 2.6% of its 13F portfolio is allocated to the stock. Remaining members of the smart money that hold long positions contain Lee Ainslie’s Maverick Capital, Cliff Asness’ AQR Capital Management, and Ross Margolies’ Stelliam Investment Management.

Due to the fact that U.S. Bancorp (NYSE:USB) has experienced bearish sentiment from the entirety of the hedge funds we track, we can see that there was a specific group of hedgies who sold off their full holdings during the third quarter. Intriguingly, Jean-Marie Eveillard’s First Eagle Investment Management sold off the largest position of all the hedgies watched by Insider Monkey, comprising close to $458.1 million in stock. Lou Simpson’s fund, SQ Advisors, also dumped its stock, about $62.4 million worth.

Let’s now review hedge fund activity in other stocks – not necessarily in the same industry as U.S. Bancorp (NYSE:USB) but similarly valued. These stocks are Danaher Corporation (NYSE:DHR), Costco Wholesale Corporation (NASDAQ:COST), BHP Billiton plc (ADR) (NYSE:BBL), and Simon Property Group, Inc (NYSE:SPG). This group of stocks’ market caps match USB’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| DHR | 54 | 1992183 | 0 |

| COST | 50 | 2377583 | 11 |

| BBL | 18 | 323894 | -1 |

| SPG | 20 | 893010 | -1 |

As you can see these stocks had an average of 36 funds with bullish positions and the average amount invested in these stocks was $1.40 billion. That figure was $4.63 billion in USB’s case. Danaher Corporation (NYSE:DHR) is the most popular stock in this table with 54 funds holding shares. On the other hand, BHP Billiton plc (ADR) (NYSE:BBL) is the least popular one with only 18 bullish hedge fund positions. U.S. Bancorp (NYSE:USB) is not the most popular stock in this group, but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard, Danaher Corporation (NYSE:DHR) might be a better candidate to consider a long position.