The successful funds run by legendary investors such as Dan Loeb and David Tepper make hundreds of millions of dollars for themselves and their investors by spending enormous resources doing research on small cap stocks that big investment banks don’t follow. Because of their pay structures, they have strong incentive to do the research necessary to beat the market. That’s why we pay close attention to what they think in small cap stocks. In this article, we take a closer look at Trevena Inc (NASDAQ:TRVN) from the perspective of those successful funds.

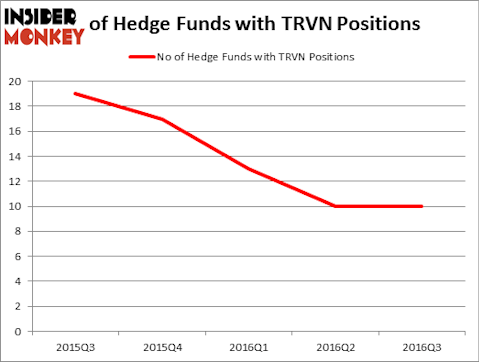

Hedge fund interest in Trevena Inc (NASDAQ:TRVN) shares was flat at the end of last quarter, and there were 10 hedge funds with long positions in the company. This is usually a negative indicator. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Covenant Transportation Group, Inc. (NASDAQ:CVTI), NQ Mobile Inc (ADR) (NYSE:NQ), and Park Electrochemical Corp. (NYSE:PKE) to gather more data points.

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Syda Productions/Shutterstock.com

How are hedge funds trading Trevena Inc (NASDAQ:TRVN)?

At Q3’s end, a total of 10 of the hedge funds tracked by Insider Monkey were bullish on this stock, unchanged from the previous quarter. Below, you can check out the change in hedge fund sentiment towards TRVN over the last 5 quarters. With hedgies’ sentiment swirling, there exists an “upper tier” of noteworthy hedge fund managers who were upping their holdings substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Dmitry Balyasny’s Balyasny Asset Management has the biggest position in Trevena Inc (NASDAQ:TRVN), worth close to $12.2 million. The second most bullish fund manager is Millennium Management, one of the 10 largest hedge funds in the world, with a $7.3 million position. Some other professional money managers with similar optimism consist of Ken Griffin’s Citadel Investment Group, Kevin Kotler’s Broadfin Capital and Julian Baker and Felix Baker’s Baker Bros. Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

We view hedge fund activity in the stock unfavorable, but in this case there was only a single hedge fund selling its entire position: Springbok Capital. One hedge fund selling its entire position doesn’t always imply a bearish intent. Theoretically a hedge fund may decide to sell a promising position in order to invest the proceeds in a more promising idea. However, we don’t think this is the case in this case because only one of the 800+ hedge funds tracked by Insider Monkey identified as a viable investment and initiated a position in the stock (that fund was D E Shaw).

Let’s go over hedge fund activity in other stocks – not necessarily in the same industry as Trevena Inc (NASDAQ:TRVN) but similarly valued. These stocks are Covenant Transportation Group, Inc. (NASDAQ:CVTI), NQ Mobile Inc (ADR) (NYSE:NQ), Park Electrochemical Corp. (NYSE:PKE), and Western Asset High Yield Defined Opportunity Fund Inc. (NYSE:HYI). This group of stocks’ market values are closest to TRVN’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| CVTI | 8 | 18452 | 3 |

| NQ | 8 | 10417 | 1 |

| PKE | 7 | 80580 | 0 |

| HYI | 1 | 2363 | -1 |

As you can see these stocks had an average of 6 hedge funds with bullish positions and the average amount invested in these stocks was $28 million. That figure was $33 million in TRVN’s case. Covenant Transportation Group, Inc. (NASDAQ:CVTI) is the most popular stock in this table. On the other hand Western Asset High Yield Defined Opportunity Fund Inc. (NYSE:HYI) is the least popular one with only 1 bullish hedge fund positions. Compared to these stocks Trevena Inc (NASDAQ:TRVN) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: None