A 276.5% annual return isn’t something you see everyday, especially in the automobile industry. That’s what Tesla Motors Inc (NASDAQ:TSLA) is all about: growth. Such a return dwarfs even the 85% seen by Ford Motor Company (NYSE:F) or the 70% of Toyota Motor Corporation (ADR) (NYSE:TM), which has recently benefited from a weaker yen. Yet, Tesla Motors Inc (NASDAQ:TSLA) not only has managed to almost triple its market capitalization in one year (currently $13.83B), but some of its most optimistic supporters consider this just the beginning, as they see Tesla as the future of transportation. But, objectively speaking, does Tesla really represent the future of transportation, or is it yet another story of market insanity?

Understanding Tesla

We have to start by admitting that Tesla Motors Inc (NASDAQ:TSLA) isn’t a normal auto stock. Unlike Ford, it does not have to deal with strong unions, due to the small size of the company. It enjoys tax credits for the time being, at least until the company manages to sell 200,000 electric cars (after that, the tax credits are expected to decrease). Unlike Toyota, it is not heavily exposed to currency fluctuations yet. And unlike both Ford and Toyota, it actually benefits a lot from stricter environmental laws, which make normal cars more expensive to produce.

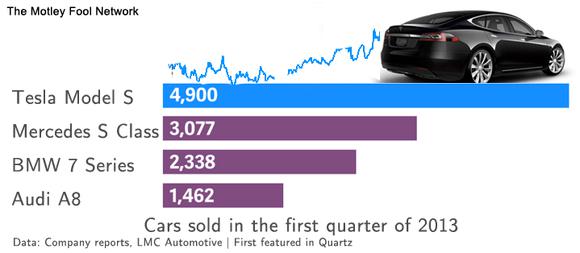

Finally, because its product is quite attractive and new to most consumers, it doesn’t need to invest heavily on advertising for the time being. Notice, however, that all these apparently strong competitive advantages are not scalable. As Tesla Motors Inc (NASDAQ:TSLA) continues increasing production, it will lose most of the advantages mentioned earlier, from enjoying tax credits to having a low marketing budget. Well, Tesla is increasing production steadily. In the first quarter of 2013, the Model S electric sports sedan outsold by wide margins the Mercedes S Class, the BMW 7 Series and the Audi A8. At first glance, this looks great. But considering Tesla’s main advantages are not scalable, it also brings worries.

Profitability

Even if Tesla Motors Inc (NASDAQ:TSLA) is about to lose some significant benefits, in theory everything should be all right if the car manufacturer enjoys economies of scale. As production increases and fixed costs get more diluted, Tesla could use its higher margins to offset the negative effect of having no more tax credits. But will Tesla be able to increase its margins? So far, the current gross margin without credits is a mere 2.3%, although Tesla CEO Elon Musk has stated that his goal is to achieve a 25% gross margin for Tesla’s high-end cars without the inclusion of regular credits. This is higher than BMW’s 19% overall gross margins, and I personally have no idea how Tesla will be able to achieve this in the coming years, as the guidance looks pretty high.

The bear case

The bear case, presented by Mark B. Spiegel, generously assumes that Tesla will indeed achieve a 25% gross margin for its high-end cars. If by 2018 Tesla sells 80,000 high-end vehicles at an average price of $85,000 per unit and 200,000 Gen 3 cars (with a 15% profit margin) at an average price of $45,000 per unit, the company would be worth $15.8 billion (revenue). At a 1.3x BMW-like valuation multiple, that is $18.6 billion. Notice that this is a very optimistic scenario.