Several hedge fund billionaires took advantage of the sharp declines in broader market indices during the 5 hours following Donald Trump’s election victory. In this case markets wised up pretty quickly and the selloffs turned into rallies. Information disseminates very quickly in liquid markets, however, the rate of adjustment is usually slower when it comes to much smaller and less liquid markets. By tracking the hedge fund sentiment in publicly traded US stocks Insider Monkey aims to tap into hedge funds’ wisdom without paying them an arm and a leg. Historically their stock picks in small-cap stocks proved to be the most profitable. Let’s study the hedge fund sentiment to see how recent events affected their ownership of Sun Communities Inc (NYSE:SUI) during the quarter.

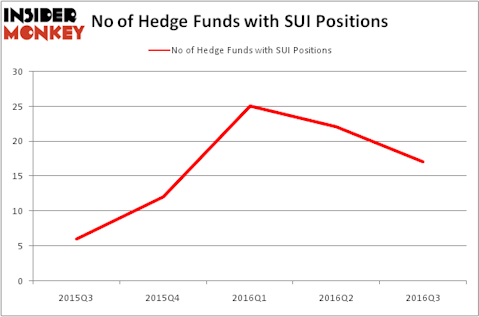

Sun Communities Inc (NYSE:SUI) investors should pay attention to a decrease in activity from the world’s largest hedge funds recently. SUI was in 17 hedge funds’ portfolios at the end of September. There were 22 hedge funds in our database with SUI holdings at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Senior Housing Properties Trust (NYSE:SNH), United Microelectronics Corp (ADR) (NYSE:UMC), and Southwestern Energy Company (NYSE:SWN) to gather more data points.

Follow Sun Communities Inc (NYSE:SUI)

Follow Sun Communities Inc (NYSE:SUI)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

designer491/Shutterstock.com

Keeping this in mind, let’s take a glance at the key action regarding Sun Communities Inc (NYSE:SUI).

What does the smart money think about Sun Communities Inc (NYSE:SUI)?

Heading into the fourth quarter of 2016, a total of 17 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -23% from the previous quarter. By comparison, 12 hedge funds held shares or bullish call options in SUI heading into this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

When looking at the institutional investors followed by Insider Monkey, Millennium Management, led by Israel Englander, holds the number one position in Sun Communities Inc (NYSE:SUI). Millennium Management has a $87.5 million position in the stock, comprising 0.1% of its 13F portfolio. Sitting at the No. 2 spot is Stuart J. Zimmer of Zimmer Partners, with a $51 million position; 1.4% of its 13F portfolio is allocated to the company. Remaining members of the smart money that hold long positions include Michael Swotes’s Castle Ridge Investment Management, Ken Griffin’s Citadel Investment Group and Jim Simons’s Renaissance Technologies. We should note that Zimmer Partners is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Because Sun Communities Inc (NYSE:SUI) has encountered a decline in interest from the smart money, it’s safe to say that there exists a select few fund managers that decided to sell off their positions entirely last quarter. Interestingly, Mark T. Gallogly’s Centerbridge Partners cashed in the biggest stake of the “upper crust” of funds tracked by Insider Monkey, totaling about $255.2 million in stock. Malcolm Fairbairn’s fund, Ascend Capital, also dumped its stock, about $8.3 million worth.

Let’s now take a look at hedge fund activity in other stocks similar to Sun Communities Inc (NYSE:SUI). We will take a look at Senior Housing Properties Trust (NYSE:SNH), United Microelectronics Corp (ADR) (NYSE:UMC), Southwestern Energy Company (NYSE:SWN), and TFS Financial Corporation (NASDAQ:TFSL). This group of stocks’ market values are closest to SUI’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| SNH | 13 | 83107 | -3 |

| UMC | 8 | 31362 | -1 |

| SWN | 37 | 1263324 | -11 |

| TFSL | 12 | 162239 | 2 |

As you can see these stocks had an average of 17.5 hedge funds with bullish positions and the average amount invested in these stocks was $385 million. That figure was $236 million in SUI’s case. Southwestern Energy Company (NYSE:SWN) is the most popular stock in this table. On the other hand United Microelectronics Corp (ADR) (NYSE:UMC) is the least popular one with only 8 bullish hedge fund positions. Sun Communities Inc (NYSE:SUI) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard SWN might be a better candidate to consider taking a long position in.