Reputable billionaire investors such as Nelson Peltz and David Tepper generate exorbitant profits for their wealthy accredited investors (a minimum of $1 million in investable assets would be required to invest in a hedge fund and most successful hedge funds won’t accept your savings unless you commit at least $5 million) by pinpointing winning small-cap stocks. There is little or no publicly-available information at all on some of these small companies, which makes it hard for an individual investor to pin down a winner within the small-cap space. However, hedge funds and other big asset managers can do the due diligence and analysis for you instead, thanks to their highly-skilled research teams and vast resources to conduct an appropriate evaluation process. Looking for potential winners within the small-cap galaxy of stocks? We believe following the smart money is a good starting point.

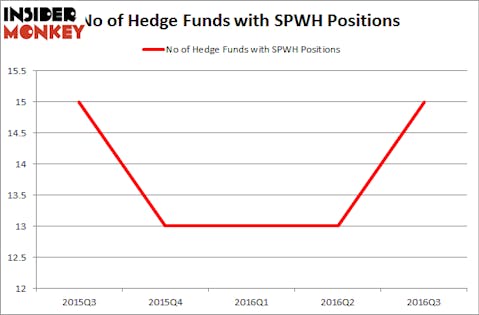

Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) investors should pay attention to an increase in activity from the world’s largest hedge funds in recent months. SPWH was in 15 hedge funds’ portfolios at the end of September. There were 13 hedge funds in our database with SPWH positions at the end of the previous quarter. At the end of this article we will also compare SPWH to other stocks including Heritage Commerce Corp. (NASDAQ:HTBK), San Juan Basin Royalty Trust (NYSE:SJT), and Boingo Wireless Inc (NASDAQ:WIFI) to get a better sense of its popularity.

Follow Sportsman's Warehouse Holdings Inc. (NASDAQ:SPWH)

Follow Sportsman's Warehouse Holdings Inc. (NASDAQ:SPWH)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Daxiao Productions/Shutterstock.com

What does the smart money think about Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH)?

At Q3’s end, a total of 15 of the hedge funds tracked by Insider Monkey held long positions in this stock, a rise of 15% from one quarter earlier. By comparison, 13 hedge funds held shares or bullish call options in SPWH heading into this year. With hedge funds’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Jamie Mendola’s Pacific Grove Capital has the biggest position in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH), worth close to $8.2 million, amounting to 3.1% of its total 13F portfolio. The second most bullish fund manager is Steve Cohen of Point72 Asset Management, with a $7.9 million position. Some other members of the smart money with similar optimism contain Israel Englander’s Millennium Management, and Anand Parekh’s Alyeska Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, specific money managers have been driving this bullishness. Point72 Asset Management, led by Steve Cohen, assembled the most valuable position in Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). Point72 Asset Management had $7.9 million invested in the company at the end of the quarter. Alexander Mitchell’s Scopus Asset Management also initiated a $5.1 million position during the quarter. The other funds with new positions in the stock are Brad Farber’s Atika Capital, Noam Gottesman’s GLG Partners, and Mike Vranos’ Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH). We will take a look at Heritage Commerce Corp. (NASDAQ:HTBK), San Juan Basin Royalty Trust (NYSE:SJT), Boingo Wireless Inc (NASDAQ:WIFI), and Culp, Inc. (NYSE:CFI). This group of stocks’ market valuations resemble SPWH’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| HTBK | 7 | 11636 | -1 |

| SJT | 6 | 9223 | -1 |

| WIFI | 15 | 65884 | -1 |

| CFI | 8 | 27763 | 0 |

As you can see these stocks had an average of 9 hedge funds with bullish positions and the average amount invested in these stocks was $29 million. That figure was $41 million in SPWH’s case. Boingo Wireless Inc (NASDAQ:WIFI) is the most popular stock in this table. On the other hand San Juan Basin Royalty Trust (NYSE:SJT) is the least popular one with only 6 bullish hedge fund positions. Sportsman’s Warehouse Holdings Inc (NASDAQ:SPWH) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard WIFI might be a better candidate to consider taking a long position in.

Disclosure: None