You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

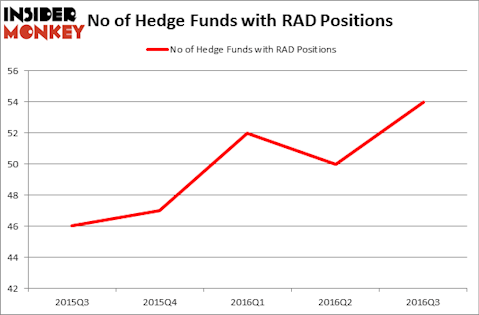

One of the stocks that registered an increase in popularity among hedge funds is Rite Aid Corporation (NYSE:RAD), in which 54 funds tracked by us held shares at the end of September, up from 50 funds at the end of the previous quarter. At the end of this article we will also compare RAD to other stocks including Varian Medical Systems, Inc. (NYSE:VAR), Quintiles Transnational Holdings Inc (NYSE:Q), and UGI Corp (NYSE:UGI) to get a better sense of its popularity.

Follow New Rite Aid Llc (NYSE:NONE)

Follow New Rite Aid Llc (NYSE:NONE)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

LalithHerath/Shutterstock.com

Keeping this in mind, let’s go over the key action encompassing Rite Aid Corporation (NYSE:RAD).

Hedge fund activity in Rite Aid Corporation (NYSE:RAD)

At the end of the third quarter, 54 funds tracked by Insider Monkey were long Rite Aid Corporation, an increase of 8% from the second quarter. With hedgies’ positions undergoing their usual ebb and flow, there exists a few notable hedge fund managers who were increasing their stakes significantly (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Arrowgrass Capital Partners, managed by Nick Niell, holds the largest position in Rite Aid Corporation (NYSE:RAD). Arrowgrass Capital Partners has a $185.4 million position in the stock, comprising 2.5% of its 13F portfolio. Coming in second is Matthew Halbower’s Pentwater Capital Management, with a $153.8 million position; the fund has 1.4% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism contain David Einhorn’s Greenlight Capital and Shane Finemore’s Manikay Partners.