Billionaire hedge fund managers such as Steve Cohen and Stan Druckenmiller can generate millions or even billions of dollars every year by pinning down high-potential small-cap stocks and pouring cash into these candidates. Small-cap stocks are overlooked by most investors, brokerage houses, and financial services hubs, while the unlimited research abilities of the big players within the hedge fund industry can easily identify the undervalued and high-potential stocks that reside the ignored corners of equity markets. There are numerous small-cap stocks that have turned out to be great winners, which is one of the main reasons the Insider Monkey team pays close attention to the hedge fund activity in relation to these stocks.

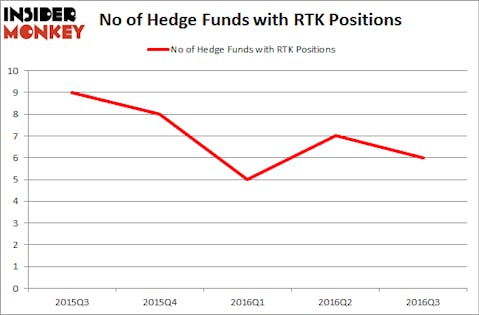

Is Rentech, Inc. (NASDAQ:RTK) ready to rally soon? Prominent investors are indeed getting less bullish. The number of bullish hedge fund positions fell by 1 in recent months. There were 7 hedge funds in our database with RTK positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Vericel Corp (NASDAQ:VCEL), Intec Pharma Ltd (NASDAQ:NTEC), and Vermillion, Inc. (NASDAQ:VRML) to gather more data points.

Follow Rentech Inc. (NASDAQ:RTK)

Follow Rentech Inc. (NASDAQ:RTK)

Receive real-time insider trading and news alerts

We follow over 700 hedge funds and other institutional investors and by analyzing their quarterly 13F filings, we identify stocks that they are collectively bullish on and develop investment strategies based on this data. One strategy that outperformed the market over the last year involves selecting the 100 best-performing funds and identifying the 30 mid-cap stocks that they are collectively most bullish on. Over the past year, this strategy generated returns of 18%, topping the 8% gain registered by S&P 500 ETFs. We launched this strategy 2.5 years ago and it returned more than 39% since then, vs. 22% gain registered by the S&P 500 ETFs.

Patryk Kosmider/Shutterstock.com

Hedge fund activity in Rentech, Inc. (NASDAQ:RTK)

Heading into the fourth quarter of 2016, a total of 6 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of -14% from the previous quarter. On the other hand, there were a total of 8 hedge funds with a bullish position in RTK at the beginning of this year. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

According to Insider Monkey’s hedge fund database, John W. Rogers’ Ariel Investments has the largest position in Rentech, Inc. (NASDAQ:RTK), worth close to $7.3 million, comprising 0.1% of its total 13F portfolio. Coming in second is Jeffrey E. Eberwein of Lone Star Value Management, with a $2.9 million position; 5.4% of its 13F portfolio is allocated to the company. Remaining peers that are bullish include Jim Simons’ Renaissance Technologies, one of the largest hedge funds in the world, Israel Englander’s Millennium Management and Ken Griffin’s Citadel Investment Group. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Rentech, Inc. (NASDAQ:RTK) has gone through bearish sentiment from the aggregate hedge fund industry, logic holds that there were a few funds that slashed their full holdings in the third quarter. At the top of the heap, Philip Hempleman’s Ardsley Partners cashed in the biggest investment of the “upper crust” of funds watched by Insider Monkey, valued at an estimated $0.2 million in stock. Ben Levine, Andrew Manuel and Stefan Renold’s fund, LMR Partners, also said goodbye to its stock, about $0.1 million worth.

Let’s go over hedge fund activity in other stocks similar to Rentech, Inc. (NASDAQ:RTK). These stocks are Vericel Corp (NASDAQ:VCEL), Intec Pharma Ltd (NASDAQ:NTEC), Vermillion, Inc. (NASDAQ:VRML), and Comstock Mining, Inc. (NYSEMKT:LODE). This group of stocks’ market values are similar to RTK’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| VCEL | 5 | 9663 | -1 |

| NTEC | 4 | 8843 | 0 |

| VRML | 4 | 4183 | 1 |

| LODE | 2 | 3745 | -2 |

As you can see these stocks had an average of 4 hedge funds with bullish positions and the average amount invested in these stocks was $7 million. That figure was $13 million in RTK’s case. Vericel Corp (NASDAQ:VCEL) is the most popular stock in this table. On the other hand Comstock Mining, Inc. (NYSEMKT:LODE) is the least popular one with only 2 bullish hedge fund positions. Compared to these stocks Rentech, Inc. (NASDAQ:RTK) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.