You probably know from experience that there is not as much information on small-cap companies as there is on large companies. Of course, this makes it really hard and difficult for individual investors to make proper and accurate analysis of certain small-cap companies. However, well-known and successful hedge fund investors like Carl Icahn and George Soros hold the necessary resources and abilities to conduct an extensive stock analysis on small-cap stocks, which enable them to make millions of dollars by identifying potential winners within the small-cap galaxy of stocks. This represents the main reason why Insider Monkey takes notice of the hedge fund activity in these overlooked stocks.

One stock that saw an increase in confidence from smart money investors last quarter is Proteostasis Therapeutics Inc (NASDAQ:PTI), in which the number of funds from our database long the stock jumped by eight. At the end of this article we will also compare PTI to other stocks including Perry Ellis International, Inc. (NASDAQ:PERY), AR Capital Acquisition Corp (NASDAQ:AUMA), and Addus Homecare Corporation (NASDAQ:ADUS) to get a better sense of its popularity.

Follow Kineta Inc. (NASDAQ:KANT)

Follow Kineta Inc. (NASDAQ:KANT)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

everything possible/Shutterstock.com

With all of this in mind, let’s take a gander at the new action regarding Proteostasis Therapeutics Inc (NASDAQ:PTI).

What does the smart money think about Proteostasis Therapeutics Inc (NASDAQ:PTI)?

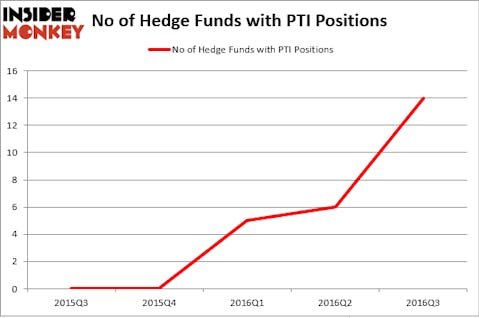

Heading into the fourth quarter of 2016, a 14 of the hedge funds tracked by Insider Monkey were long this stock, compared to just six funds at the end of June. The graph below displays the number of hedge funds with bullish position in PTI over the last five quarters. So, let’s see which hedge funds were among the top holders of the stock and which hedge funds were making big moves.

Of the funds tracked by Insider Monkey, Bihua Chen’s Cormorant Asset Management has the biggest position in Proteostasis Therapeutics Inc (NASDAQ:PTI), worth close to $36.6 million, corresponding to 4% of its total 13F portfolio. Sitting at the No. 2 spot is Lei Zhang’s Hillhouse Capital Management, holding a $11.9 million position; 0.2% of its 13F portfolio is allocated to the stock. Some other peers with similar optimism comprise Kris Jenner, Gordon Bussard, Graham McPhail’s Rock Springs Capital Management and Joseph Edelman’s Perceptive Advisors. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

With a general bullishness amongst the heavyweights, specific money managers have jumped into Proteostasis Therapeutics Inc (NASDAQ:PTI) headfirst. Hillhouse Capital Management assembled the most outsized position in Proteostasis Therapeutics Inc (NASDAQ:PTI). Oleg Nodelman’s EcoR1 Capital also made a $9.4 million investment in the stock during the quarter. The other funds with new positions in the stock are Paul Marshall and Ian Wace’s Marshall Wace LLP, James E. Flynn’s Deerfield Management, and Behzad Aghazadeh’s venBio Select Advisor.

Let’s check out hedge fund activity in other stocks – not necessarily in the same industry as Proteostasis Therapeutics Inc (NASDAQ:PTI) but similarly valued. These stocks are Perry Ellis International, Inc. (NASDAQ:PERY), AR Capital Acquisition Corp (NASDAQ:AUMA), Addus Homecare Corporation (NASDAQ:ADUS), and TICC Capital Corp. (NASDAQ:TICC). All of these stocks’ market caps are closest to PTI’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| PERY | 12 | 20434 | 0 |

| AUMA | 11 | 117855 | 0 |

| ADUS | 5 | 7820 | -1 |

| TICC | 5 | 5782 | -3 |

As you can see these stocks had an average of eight hedge funds with bullish positions and the average amount invested in these stocks was $38 million, versus $89 million in PTI’s case. Perry Ellis International, Inc. (NASDAQ:PERY) is the most popular stock in this table, while Addus Homecare Corporation (NASDAQ:ADUS) is the least popular one with only five bullish hedge fund positions. Compared to these stocks Proteostasis Therapeutics Inc (NASDAQ:PTI) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

Disclosure: none