The SEC requires hedge funds and wealthy investors with over a certain portfolio size to file a report that shows their positions at the end of every quarter. Even though it isn’t the intention, these filings level the playing field for ordinary investors. The latest round of 13F filings discloses the funds’ positions on September 30. We at Insider Monkey have compiled an extensive database of more than 700 of those elite funds and prominent investors’ filings. In this article, we analyze how these elite funds and prominent investors traded Packaging Corp Of America (NYSE:PKG) based on those filings.

Is Packaging Corp Of America (NYSE:PKG) a good investment now? The smart money is in a bullish mood. The number of bullish hedge fund positions went up by 1 lately. At the end of this article we will also compare PKG to other stocks including Leucadia National Corp. (NYSE:LUK), IDEX Corporation (NYSE:IEX), and Taro Pharmaceutical Industries Ltd. (NYSE:TARO) to get a better sense of its popularity.

Follow Packaging Corp Of America (NYSE:PKG)

Follow Packaging Corp Of America (NYSE:PKG)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

Borkin Vadim/Shutterstock.com

Hedge fund activity in Packaging Corp Of America (NYSE:PKG)

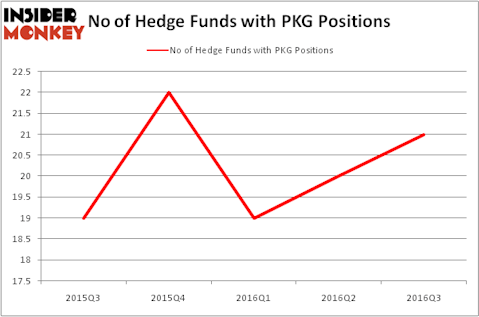

At Q3’s end, a total of 21 of the hedge funds tracked by Insider Monkey were long this stock, a 5% rise from the previous quarter. Hedge fund ownership has remained within a narrow range over the past year, with between 19 and 22 hedge funds holding the stock throughout that time. With hedge funds’ sentiment swirling, there exists an “upper tier” of notable hedge fund managers who were boosting their holdings meaningfully (or already accumulated large positions).

Of the funds tracked by Insider Monkey, Cliff Asness’ AQR Capital Management has the number one position in Packaging Corp Of America (NYSE:PKG), worth close to $57.5 million. Sitting at the No. 2 spot is Gotham Asset Management, managed by Joel Greenblatt, which holds a $27.2 million position. Other members of the smart money that hold long positions consist of Michael O’Keefe’s 12th Street Asset Management, Ken Griffin’s Citadel Investment Group and Benjamin A. Smith’s Laurion Capital Management.