Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Oracle Corporation (NASDAQ:ORCL) fit the bill? Let’s look at what its recent results tell us about its potential for future gains.

The graphs you’re about to see tell Oracle Corporation (NASDAQ:ORCL)’s story, and we’ll be grading the quality of that story in several ways:

- Growth: are profits, margins, and free cash flow all increasing?

- Valuation: is share price growing in line with earnings per share?

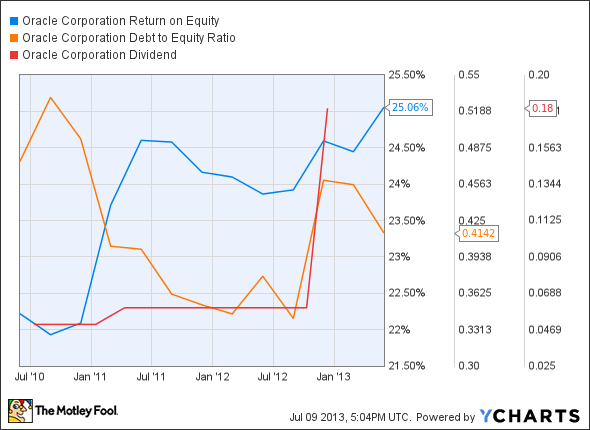

- Opportunities: is return on equity increasing while debt to equity declines?

- Dividends: are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let’s take a look at Oracle Corporation (NASDAQ:ORCL)’s key statistics:

ORCL Total Return Price data by YCharts.

| Criteria | 3-Year* Change | Grade |

|---|---|---|

| Revenue growth > 30% | 38.60% | Pass |

| Improving profit margin | 28.50% | Pass |

| Free cash flow growth > Net income growth | 60.6% vs. 78.1% | Fail |

| Improving EPS | 86.80% | Pass |

| Stock growth (+ 15%) < EPS growth | 41.7% vs. 86.8% | Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

ORCL Return on Equity data by YCharts.

| Criteria | 3-Year* Change | Grade |

|---|---|---|

| Improving return on equity | 12.8% | Pass |

| Declining debt to equity | (13%) | Pass |

| Dividend growth > 25% | 260% | Pass |

| Free cash flow payout ratio < 50% | 10.8% | Pass |

Source: YCharts.

*Period begins at end of Q2 2010.

How we got here and where we’re going

Oracle Corporation (NASDAQ:ORCL) just about knocks it out of the park here, with eight out of nine possible passing grades, and it has a very good chance to gain a perfect score next time around. It lost out on a perfect score only because net income outpaced free cash flow during our tracked period — however, the raw numbers reveal that Oracle Corporation (NASDAQ:ORCL)’s free cash flow is more than $2 billion higher than its net income. That makes it an even more appealing value, as its price-to-free cash flow ratio is presently barely in double-digit territory. How could Oracle Corporation (NASDAQ:ORCL) push its revenue even higher over the next few quarters and gain that last elusive passing grade? Let’s dig a little deeper.

Investors’ biggest fear has been that the software giant has been (or is being) left behind by its peers when it comes to the cloud-computing revolution. Oracle has traditionally made its money by licensing software to businesses, and to a lesser extent, through hardware sales via its Sun Microsystems subsidiary. Neither has posted particularly strong growth for Oracle, as enterprises are turning to cloud software that allows employees to access company-critical data no matter where they work.