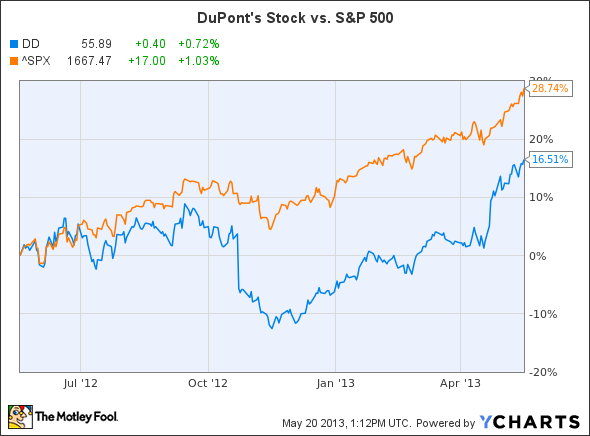

With a market that seems to hit new highs every day, it’s getting tougher to find a good business trading at a fair price. One stock that i’m starting to look at is E I Du Pont De Nemours And Co (NYSE:DD). Unfortunately, for me at least, so far this year the stock is up just over 24% while the S&P 500 is up about 17%. That’s pretty good outperformance, though, if you look out over the past year you’ll see a slightly different story:

So, while E I Du Pont De Nemours And Co (NYSE:DD)’s stock has been strong of late, it has lagged the benchmark over the past year. In fact, it’s lagged the average over the past five- and 10-year periods as well. Strong past price appreciation can mean business is booming, while a lagging stock price usually means a company has fallen out of favor with investors. Sometimes it can stay out of favor for too long, as investors miss the fact that its business is turning around, which is usually a good opportunity to find a company trading at a compelling price. Let’s take a deeper look at E I Du Pont De Nemours And Co (NYSE:DD) to determine if that’s the case.

E I Du Pont De Nemours And Co (NYSE:DD) has been enhancing its portfolio to pursue growth opportunities that create higher value. That transition has seen the company add Danisco, a global enzyme and specialty food ingredients company, to its portfolio while jettisoning its performance coatings business. Through this transition DuPont has become more focused on science and innovation, which yields higher margins, while exiting a lower-margin commodity business like performance coatings.

This is part of a transition that has the company maximizing its business portfolio around its purpose to be a science company. E I Du Pont De Nemours And Co (NYSE:DD)’s strategy is to build and leverage its science lead in three specific focus areas: agriculture and nutrition, bio-based industrials, and advanced materials. That focus on science and development is starting to bear fruit as you can see in the slide below:

Source: DuPont Investor Presentation

While DuPont has built a diversified business around its three focus areas, it still faces stiff competition. For example its agriculture business, which focuses on seeds, traits, and crop protection puts it up against the likes of Monsanto Company (NYSE:MON) and The Dow Chemical Company (NYSE:DOW). That competition with Monsanto cost the company a lot of money in legal fees and ended with DuPont agreeing to a $1.75 billion licensing deal with the seed giant. The good news, though, is that now instead of competing against Monsanto Company (NYSE:MON), the two will be collaborating as DuPont gains access to some key patents in Monsanto’s portfolio.

Despite that monetary loss, DuPont has a vast intellectual property portfolio which provides it with a strong base for future growth. To that end, DuPont has set long-term-growth targets to grow its sales by 7% each year while its operating earnings are expected to grow by a 12% annual clip. That’s pretty solid growth and shows how well the company is at turning its innovation into returns.

That being said, if there is a problem with DuPont, it’s with the company’s stock price. With a price to earnings ratio of around 20 times, it’s hard to call the company a value stock as investors are paying nearly twice the earnings growth rate for the company. While it’s trading at a cheaper valuation than Dow Chemical for example, analysts expect The Dow Chemical Company (NYSE:DOW)’s earnings to grow much faster over the next two years. Further, Dow’s stock pays a higher dividend, which is likely headed even higher in the future.