At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

Is Northstar Realty Europe Corp (NYSE:NRE) an attractive investment today? The best stock pickers are unambiguously in a pessimistic mood. The number of long hedge fund bets decreased by 5 recently. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as New York Mortgage Trust, Inc. (NASDAQ:NYMT), Manitowoc Company, Inc. (NYSE:MTW), and Intra-Cellular Therapies Inc (NASDAQ:ITCI) to gather more data points.

Follow Northstar Realty Europe Corp. (NYSE:NRE)

Follow Northstar Realty Europe Corp. (NYSE:NRE)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Aleksandr Bagri/Shutterstock.com

What does the smart money think about Northstar Realty Europe Corp (NYSE:NRE)?

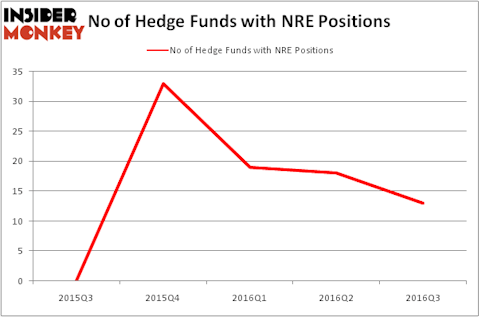

Heading into the fourth quarter of 2016, a total of 13 of the hedge funds tracked by Insider Monkey held long positions in this stock, a 28% fall from one quarter earlier. The graph below displays the number of hedge funds with bullish positions in NRE over the last 5 quarters, which has fallen sharply over the past 3 quarters. With hedgies’ capital changing hands, there exists an “upper tier” of notable hedge fund managers who were upping their stakes significantly (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, RIMA Senvest Management, led by Richard Mashaal, holds the number one position in Northstar Realty Europe Corp (NYSE:NRE). RIMA Senvest Management has a $32.9 million position in the stock, comprising 2.4% of its 13F portfolio. Sitting at the No. 2 spot is Samlyn Capital, led by Robert Pohly, which holds a $31 million position. Remaining members of the smart money that hold long positions include Daniel Gold’s QVT Financial, Steve Cohen’s Point72 Asset Management, and Phill Gross and Robert Atchinson’s Adage Capital Management. We should note that none of these hedge funds are among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

Since Northstar Realty Europe Corp (NYSE:NRE) has encountered declining sentiment from the smart money, it’s easy to see that there were a few hedge funds that slashed their entire stakes by the end of the third quarter. Intriguingly, Michael Reeber’s Andalusian Capital Partners cashed in the biggest investment of the 700 funds tracked by Insider Monkey, worth close to $1.2 million in stock, and Andre F. Perold’s HighVista Strategies was right behind this move, as the fund dumped about $1 million worth of shares.

Let’s go over hedge fund activity in other stocks similar to Northstar Realty Europe Corp (NYSE:NRE). We will take a look at New York Mortgage Trust, Inc. (NASDAQ:NYMT), Manitowoc Company, Inc. (NYSE:MTW), Intra-Cellular Therapies Inc (NASDAQ:ITCI), and Weight Watchers International, Inc. (NYSE:WTW). This group of stocks’ market valuations resemble NRE’s market valuation.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| NYMT | 3 | 1860 | 0 |

| MTW | 23 | 169600 | -4 |

| ITCI | 19 | 74738 | -6 |

| WTW | 12 | 44533 | -6 |

As you can see these stocks had an average of 14 hedge funds with bullish positions and the average amount invested in these stocks was $73 million. That figure was $153 million in NRE’s case. Manitowoc Company, Inc. (NYSE:MTW) is the most popular stock in this table. On the other hand New York Mortgage Trust, Inc. (NASDAQ:NYMT) is the least popular one with only 3 bullish hedge fund positions. Northstar Realty Europe Corp (NYSE:NRE) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MTW might be a better candidate to consider taking a long position in.

Disclosure: None