At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

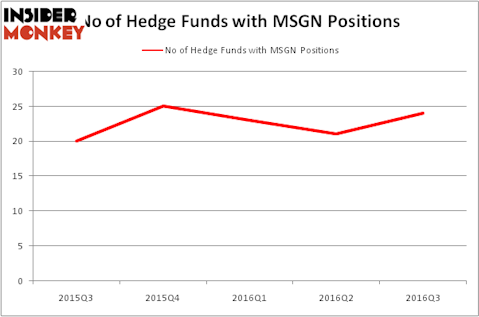

MSG Networks Inc (NYSE:MSGN) investors should be aware of an increase in support from the world’s most elite money managers recently. MSGN was in 24 hedge funds’ portfolios at the end of September. There were 21 hedge funds in our database with MSGN positions at the end of the previous quarter. At the end of this article we will also compare MSGN to other stocks including Express, Inc. (NYSE:EXPR), Seres Therapeutics Inc (NASDAQ:MCRB), and Spartan Stores, Inc. (NASDAQ:SPTN) to get a better sense of its popularity.

Follow Msg Networks Inc. (NYSE:MSGN)

Follow Msg Networks Inc. (NYSE:MSGN)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

alexwhite/Shutterstock.com

What does the smart money think about MSG Networks Inc (NYSE:MSGN)?

Heading into the fourth quarter of 2016, a total of 24 of the hedge funds tracked by Insider Monkey were bullish on this stock, a 14% rise from the previous quarter. Hedge fund ownership of the stock has remained in a narrow range of between 20 and 25 hedge funds for the past five quarters. With hedgies’ positions undergoing their usual ebb and flow, there exists an “upper tier” of notable hedge fund managers who were increasing their holdings considerably (or already accumulated large positions).

When looking at the institutional investors followed by Insider Monkey, John W. Rogers’ Ariel Investments has the largest position in MSG Networks Inc (NYSE:MSGN), worth close to $122 million, accounting for 1.5% of its total 13F portfolio. The second most bullish fund manager is GAMCO Investors, managed by Mario Gabelli, which holds a $45.6 million position. Some other members of the smart money that are bullish include Kenneth Mario Garschina’s Mason Capital Management, Dmitry Balyasny’s Balyasny Asset Management and Steve Cohen’s Point72 Asset Management.

As aggregate interest increased, some big names were breaking ground themselves. Balyasny Asset Management initiated the most outsized position in MSG Networks Inc (NYSE:MSGN). Balyasny Asset Management had $20.3 million invested in the company at the end of the quarter. Beeneet Kothari’s Tekne Capital Management also initiated a $7.7 million position during the quarter. The following funds were also among the new MSGN investors: Robert B. Gillam’s McKinley Capital Management, Charles Anderson’s Fox Point Capital Management, and Mike Vranos’ Ellington.

Let’s now take a look at hedge fund activity in other stocks similar to MSG Networks Inc (NYSE:MSGN). These stocks are Express, Inc. (NYSE:EXPR), Seres Therapeutics Inc (NASDAQ:MCRB), Spartan Stores, Inc. (NASDAQ:SPTN), and CVR Refining LP (NYSE:CVRR). This group of stocks’ market caps are similar to MSGN’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| EXPR | 26 | 162962 | 3 |

| MCRB | 13 | 25183 | -4 |

| SPTN | 18 | 55934 | 2 |

| CVRR | 6 | 52469 | -1 |

As you can see these stocks had an average of 15.75 hedge funds with bullish positions and the average amount invested in these stocks was $74 million. That figure was $324 million in MSGN’s case. Express, Inc. (NYSE:EXPR) is the most popular stock in this table. On the other hand CVR Refining LP (NYSE:CVRR) is the least popular one with only 6 bullish hedge fund positions. MSG Networks Inc (NYSE:MSGN) is not the most popular stock in this group but hedge fund interest is still above average. This is a slightly positive signal but we’d rather spend our time researching stocks that hedge funds are piling on. In this regard EXPR might be a better candidate to consider a long position.

Disclosure: None