Although MTG shares have retraced since their mid-October highs due to some traders taking profits on the run-up since June as some analysts become more cautious due to valuation purposes, many hedge funds feel MTG has upside given that industry pricing has stabilized and there is talk of industry consolidation in the future. More consolidation generally leads to more favorable margins for the industry. In addition, MTG’s downside is no longer as great as it was during the financial crisis because sector underwriting standards have tightened considerably.

How are hedge funds trading MGIC Investment Corp. (NYSE:MTG)?

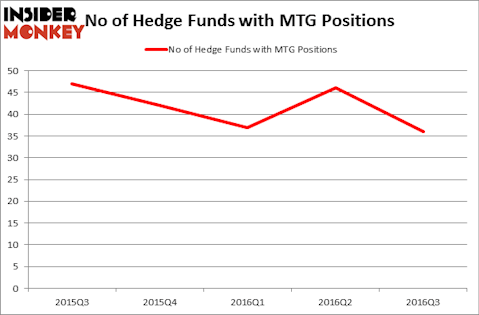

At the end of the third quarter, a total of 36 of the hedge funds tracked by Insider Monkey were long this stock, down 22% from the previous quarter. With hedge funds’ capital changing hands, there exists a select group of key hedge fund managers who were increasing their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Howard Marks’s Oaktree Capital Management has the biggest position in MGIC Investment Corp. (NYSE:MTG), worth close to $72.2 million, corresponding to 0.9% of its total 13F portfolio. Coming in second is Platinum Asset Management, led by Kerr Neilson, holding a $70.4 million position; 1.6% of its 13F portfolio is allocated to the stock. Some other members of the smart money that hold long positions comprise Doug Silverman and Alexander Klabin’s Senator Investment Group, Paul Marshall and Ian Wace’s Marshall Wace LLP and Jim Simons’s Renaissance Technologies.

Judging by the fact that MGIC Investment Corp. (NYSE:MTG) has experienced falling interest from the aggregate hedge fund industry, it’s easy to see that there was a specific group of money managers who sold off their full holdings last quarter. At the top of the heap, John Paulson’s Paulson & Co sold off the biggest investment of all the hedgies monitored by Insider Monkey, comprising close to $127.1 million in stock. Emanuel J. Friedman’s fund, EJF Capital, also dumped its stock, about $27.1 million worth of MTG shares. These transactions are interesting, as total hedge fund interest fell by 10 funds last quarter.

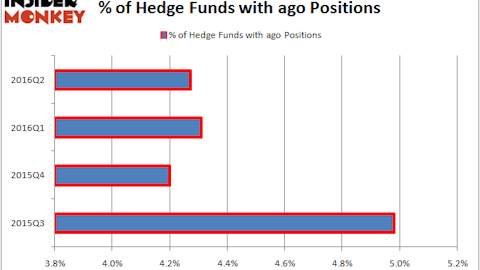

Let’s also examine hedge fund activity in other stocks similar to MGIC Investment Corp. (NYSE:MTG). These stocks are Glacier Bancorp, Inc. (NASDAQ:GBCI), Hancock Holding Company (NASDAQ:HBHC), Trinseo S.A. (NYSE:TSE), and Wolverine World Wide, Inc. (NYSE:WWW). This group of stocks’ market caps match MTG’s market cap.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| GBCI | 5 | 94491 | -1 |

| HBHC | 14 | 41985 | 3 |

| TSE | 35 | 848609 | 8 |

| WWW | 13 | 134599 | -1 |

As you can see these stocks had an average of 17 hedge funds with bullish positions and the average amount invested in these stocks was $280 million. That figure was $545 million in MTG’s case. Trinseo S.A. (NYSE:TSE) is the most popular stock in this table. On the other hand Glacier Bancorp, Inc. (NASDAQ:GBCI) is the least popular one with only 5 bullish hedge fund positions. Compared to these stocks MGIC Investment Corp. (NYSE:MTG) is more popular among hedge funds. Considering that hedge funds are fond of this stock in relation to its market cap peers, it may be a good idea to analyze it in detail and potentially include it in your portfolio.

In terms of peer valuation, MTG is attractive. When AIG sold its mortgage insurance business on August 16, for example, it received a 9.5x 2015 EPS multiple for the division. If the same multiple were applied to MTG, the company’s stock would be considerably higher. Analysts have a $9.80 per share price target.

Disclosure: none.