At Insider Monkey we track the activity of some of the best-performing hedge funds like Appaloosa Management, Baupost, and Third Point because we determined that some of the stocks that they are collectively bullish on can help us generate returns above the broader indices. Out of thousands of stocks that hedge funds invest in, small-caps can provide the best returns over the long term due to the fact that these companies are less efficiently priced and are usually under the radars of mass-media, analysts and dumb money. This is why we follow the smart money moves in the small-cap space.

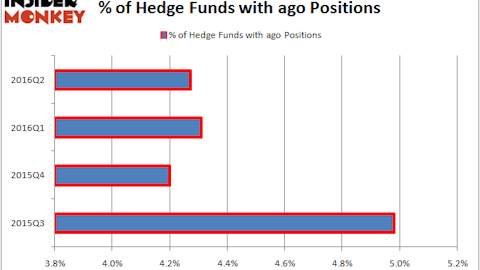

MGIC Investment Corp. (NYSE:MTG) has seen a decrease in hedge fund interest lately. MTG was in 36 hedge funds’ portfolios at the end of September. There were 46 hedge funds in our database with MTG positions at the end of the previous quarter. The level and the change in hedge fund popularity aren’t the only variables you need to analyze to decipher hedge funds’ perspectives. A stock may witness a boost in popularity but it may still be less popular than similarly priced stocks. That’s why at the end of this article we will examine companies such as Glacier Bancorp, Inc. (NASDAQ:GBCI), Hancock Holding Company (NASDAQ:HBHC), and Trinseo S.A. (NYSE:TSE) to gather more data points.

Follow Mgic Investment Corp (NYSE:MTG)

Follow Mgic Investment Corp (NYSE:MTG)

Receive real-time insider trading and news alerts

MGIC Investment Corp is a private mortgage insurer. Hedge funds like the stock because MTG is a play on the housing recovery. MTG’s earnings rise as delinquencies and claim payments fall due to lower unemployment and rising home prices. The smart money also likes MTG because its shares have considerable upside in the long term if the government decides to whittle the FHA’s presence in the housing insurance market.

Aleksandr Bagri/Shutterstock.com

MTG shares fell sharply earlier in the year after the company announced that it would raise rates on new insurance to earn acceptable returns on capital in January 2016. Many investors worried that the price hikes would cause MTG’s new insurance written to shrink. Less insurance written would eventually lead to lower profits and slower book value growth.

It turned out that the fears were unsubstantiated. For its third quarter, MTG reported earnings of $0.25 per share versus the Street’s estimate of $0.19 per share. New insurance written rose 14.4% year-over-year to $14.2 billion while insurance in force rose to inched up 4.3% to $180.1 billion. Book value increased to $7.48 per share and delinquencies fell 20.4%.