World-class money managers like Ken Griffin and Barry Rosenstein only invest their wealthy clients’ money after undertaking a rigorous examination of any potential stock. They are particularly successful in this regard when it comes to small-cap stocks, which their peerless research gives them a big information advantage on when it comes to judging their worth. It’s not surprising then that they generate their biggest returns from these stocks and invest more of their money in these stocks on average than other investors. It’s also not surprising then that we pay close attention to these picks ourselves and have built a market-beating investment strategy around them.

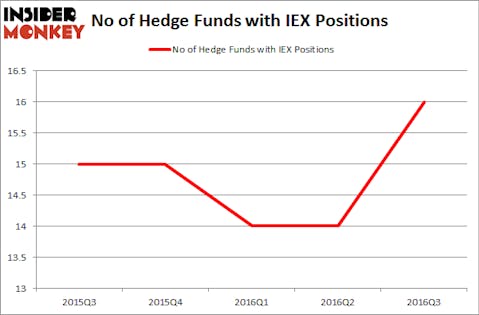

Is IDEX Corporation (NYSE:IEX) a healthy stock for your portfolio? The smart money is becoming more confident. The number of long hedge fund positions that are disclosed in regulatory 13F filings improved by 2 recently. IEX was in 16 hedge funds’ portfolios at the end of September. There were 14 hedge funds in our database with IEX positions at the end of the previous quarter. At the end of this article we will also compare IEX to other stocks including Taro Pharmaceutical Industries Ltd. (NYSE:TARO), Lennox International Inc. (NYSE:LII), and Reinsurance Group of America Inc (NYSE:RGA) to get a better sense of its popularity.

Follow Idex Corp (NYSE:IEX)

Follow Idex Corp (NYSE:IEX)

Receive real-time insider trading and news alerts

At Insider Monkey, we’ve developed an investment strategy that has delivered market-beating returns over the past 12 months. Our strategy identifies the 100 best-performing funds of the previous quarter from among the collection of 700+ successful funds that we track in our database, which we accomplish using our returns methodology. We then study the portfolios of those 100 funds using the latest 13F data to uncover the 30 most popular mid-cap stocks (market caps of between $1 billion and $10 billion) among them to hold until the next filing period. This strategy delivered 18% gains over the past 12 months, more than doubling the 8% returns enjoyed by the S&P 500 ETFs.

crystal51/Shutterstock.com

Hedge fund activity in IDEX Corporation (NYSE:IEX)

Heading into the fourth quarter of 2016, a total of 16 of the hedge funds tracked by Insider Monkey were bullish on this stock, a gain of 14% from the second quarter of 2016. On the other hand, there were a total of 15 hedge funds with a bullish position in IEX at the beginning of this year. With hedge funds’ positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes considerably (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, GAMCO Investors, led by Mario Gabelli, holds the most valuable position in IDEX Corporation (NYSE:IEX). GAMCO Investors has a $67.7 million position in the stock. Coming in second is Ian Simm of Impax Asset Management, with a $64.1 million position; the fund has 2.9% of its 13F portfolio invested in the stock. Remaining members of the smart money that hold long positions consist of John W. Rogers’ Ariel Investments, Chuck Royce’s Royce & Associates and Jim Simons’ Renaissance Technologies. We should note that Impax Asset Management is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.

As industrywide interest jumped, some big names have jumped into IDEX Corporation (NYSE:IEX) headfirst. Millennium Management, led by Israel Englander, assembled the most outsized position in IDEX Corporation (NYSE:IEX). Millennium Management had $3.1 million invested in the company at the end of the quarter. Ben Levine, Andrew Manuel and Stefan Renold’s LMR Partners also initiated a $2.8 million position during the quarter. The other funds with brand new IEX positions are Simon Sadler’s Segantii Capital and George Soros’ Soros Fund Management.

Let’s check out hedge fund activity in other stocks similar to IDEX Corporation (NYSE:IEX). We will take a look at Taro Pharmaceutical Industries Ltd. (NYSE:TARO), Lennox International Inc. (NYSE:LII), Reinsurance Group of America Inc (NYSE:RGA), and Mercadolibre Inc (NASDAQ:MELI). This group of stocks’ market values match IEX’s market value.

| Ticker | No of HFs with positions | Total Value of HF Positions (x1000) | Change in HF Position |

|---|---|---|---|

| TARO | 14 | 107519 | 2 |

| LII | 16 | 100308 | 1 |

| RGA | 19 | 286614 | 2 |

| MELI | 29 | 592569 | 8 |

As you can see these stocks had an average of 20 hedge funds with bullish positions and the average amount invested in these stocks was $272 million. That figure was $185 million in IEX’s case. Mercadolibre Inc (NASDAQ:MELI) is the most popular stock in this table. On the other hand Taro Pharmaceutical Industries Ltd. (NYSE:TARO) is the least popular one with only 14 bullish hedge fund positions. IDEX Corporation (NYSE:IEX) is not the least popular stock in this group but hedge fund interest is still below average. This is a slightly negative signal and we’d rather spend our time researching stocks that hedge funds are piling on. In this regard MELI might be a better candidate to consider taking a long position in.

Disclosure: None