Is Hexcel Corporation (NYSE:HXL) a good stock to buy right now? We at Insider Monkey like to examine what billionaires and hedge funds think of a company before doing days of research on it. Given their 2 and 20 payment structure, hedge funds have more resources than the average investor. The funds have access to expert networks and get tips from industry insiders. They also have numerous Ivy League graduates and MBAs. Like everyone else, hedge funds perform miserably at times, but their consensus picks have historically outperformed the market after risk adjustments. More recently the top 30 mid-cap stocks (market caps between $1 billion and $10 billion) among hedge funds delivered an average return of 18% during the last four quarters (S&P 500 Index funds returned only 7.6% during the same period).

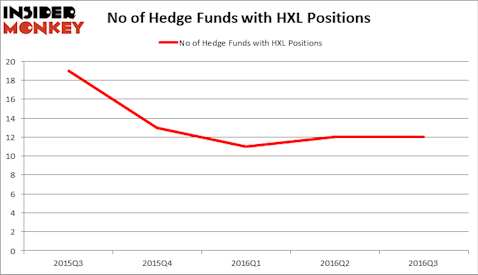

Hexcel Corporation (NYSE:HXL) shares didn’t see a lot of action during the third quarter. Overall, hedge fund sentiment was unchanged. The stock was in 12 hedge funds’ portfolios at the end of September. At the end of this article we will also compare HXL to other stocks including White Mountains Insurance Group Ltd (NYSE:WTM), Credit Acceptance Corp. (NASDAQ:CACC), and Yamana Gold Inc. (USA) (NYSE:AUY) to get a better sense of its popularity.

Follow Hexcel Corp (NYSE:HXL)

Follow Hexcel Corp (NYSE:HXL)

Receive real-time insider trading and news alerts

We care about hedge fund sentiment because historically hedge funds’ stock picks delivered strong risk adjusted returns. There are certain segments of the market where hedge funds’ stock picks performed much better than its benchmarks. For instance, the 30 most popular mid-cap stocks among the best performing hedge funds returned 18% over the last 12 months outpacing S&P 500 Index by more than 10 percentage points. We developed this strategy 2.5 years ago and started sharing its picks in our quarterly newsletter. It bested the S&P 500 Index ETFs by delivering a solid 39% vs. 22% gain for its benchmarks.

Sergey Kohl / Shutterstock.com

With all of this in mind, we’re going to go over the recent action surrounding Hexcel Corporation (NYSE:HXL).

What does the smart money think about Hexcel Corporation (NYSE:HXL)?

At the end of the third quarter, a total of 12 of the hedge funds tracked by Insider Monkey were bullish on this stock, a change of 0% from one quarter earlier. Below, you can check out the change in hedge fund sentiment towards HXL over the last 5 quarters. With the smart money’s positions undergoing their usual ebb and flow, there exists an “upper tier” of noteworthy hedge fund managers who were boosting their stakes substantially (or already accumulated large positions).

According to Insider Monkey’s hedge fund database, Robert Karr’s Joho Capital has the number one position in Hexcel Corporation (NYSE:HXL), worth close to $17.1 million, amounting to 3.4% of its total 13F portfolio. On Joho Capital’s heels is Jim Simons of Renaissance Technologies, with a $13.3 million position; the fund has less than 0.1%% of its 13F portfolio invested in the stock. Remaining professional money managers with similar optimism consist of Israel Englander’s Millennium Management, Phill Gross and Robert Atchinson’s Adage Capital Management and D E Shaw ,one of the biggest hedge funds in the world. We should note that Joho Capital is among our list of the 100 best performing hedge funds which is based on the performance of their 13F long positions in non-microcap stocks.