It’s no secret that Hewlett-Packard Company (NYSE:HPQ) is in trouble. The inveterate computing giant suffers from the waning PC market like many other sector titans, but that downtrend came at a particularly bad time for this company. Hewlett-Packard Company (NYSE:HPQ) is still reeling from the revolving-door management policy since ex-CEO Mark Hurd left the company in shambles, and current leader Meg Whitman admits that putting the pieces back together is both difficult and time-consuming.

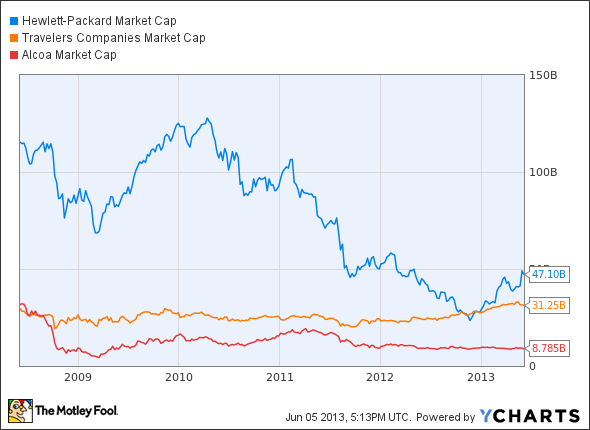

Sales are shrinking. GAAP earnings have turned negative. Share prices are down 47% in the last three trouble years, taking 168 points off the Dow Jones Industrial Average in the process. The market capitalization has dwindled from more than $100 billion to the third-smallest cap on the Dow.

HPQ Market Cap data by YCharts.

So the storm clouds are building on Hewlett-Packard Company (NYSE:HPQ)’s immediate horizon. But all is not lost — not yet.

With all of these standard metrics collapsing at once, it’s easy to overlook Hewlett-Packard Company (NYSE:HPQ)’s bright spots. In particular, the free-falling share price and last year’s huge earnings writedown combine to mask the fact that cash flows took a sharp turn in the right direction.

HPQ Free Cash Flow TTM data by YCharts.

Hewlett-Packard Company (NYSE:HPQ) generated $9.9 billion in free cash flow over the last four quarters. That’s a middling performance among the elite companies on the Dow (16 out of 30, to be exact) but a stellar result in relation to the wider market. HP’s free cash machine places in the top 5% of the S&P 500, for example.

Pair this fountain of cash with an admittedly not-so-buoyant history of dividend increases, and you’ll see that HP spent just 10.7% of its free cash to fuel that 2.4% dividend yield. That’s the third-lowest cash-payout ratio on the Dow, where financial specialists are always rolling in piles of fresh cash. The lowest cash ratio, for reference, goes to Bank of America Corp (NYSE:BAC) — a paltry 6.8% of its free cash flows go to income investors. But the megabank is still waiting for government approval to raise its payouts, and most of its business takes place below the free-cash-flow line on its enormously complicated financial statements. It’s a very different situation at HP, where cash flows form the most important bottom line of all, and no regulator is keeping its dividend policies back.

Dividend investors might wonder what would happen if HP’s board authorized a more generous set of increases, given all that cash-based headroom. In fact, Whitman and other recent HP chiefs have supported that strategy, while Mark Hurd largely left it untouched. Dividend payouts have jumped 82% in three years after flatlining for years.

HPQ Dividend data by YCharts.

So HP’s cash flows are surging, largely ignored, with plenty of headroom to increase dividend payouts even further. This moderate yield could — and arguably should — spike, even if the turnaround story doesn’t play out. That makes HP an intriguing pick for dividend investors with their eyes on the Dow 30.

The article Is Hewlett-Packard a Great Stock for today’s Dividend Investor? originally appeared on Fool.com and is written by Anders Bylund.

Fool contributor Anders Bylund holds no position in any company mentioned. Check out Anders’ bio and holdings or follow him on Twitter and Google+.The Motley Fool owns shares of Bank of America.

Copyright © 1995 – 2013 The Motley Fool, LLC. All rights reserved. The Motley Fool has a disclosure policy.